Before deciding to buy a larger or more costly flat, it's important to determine why you're doing so and if upgrading is the only option.

For some, you could be looking for a bigger living space, a preferred location, a form of property investment or even an 'upgrade' in lifestyle. However, every choice comes with trade-offs and careful planning is required to ensure that upgrading does not compromise your retirement needs.

An important question to ask yourself is whether your reason for upgrading is worth the costs and risks that come with it. Consider if you have the means to do so after you have fully evaluated the implications.

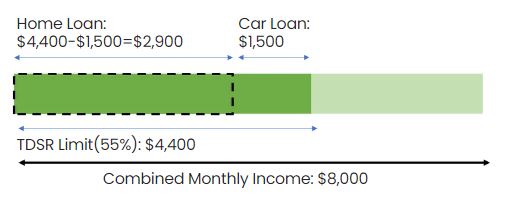

Banks now offer home loans linked to the Singapore Overnight Rate Average (SORA). It's important to be aware that the 3-month compounded SORA are currently at elevated levels.

What this means for you is the potential for an increase in your monthly housing loan payments over time. It is of paramount importance to exercise added prudence when considering borrowing and to maintain an emergency fund as a safeguard against unforeseen circumstances in the current interest rate environment. Additionally, it is crucial to approach new financial commitments with caution.

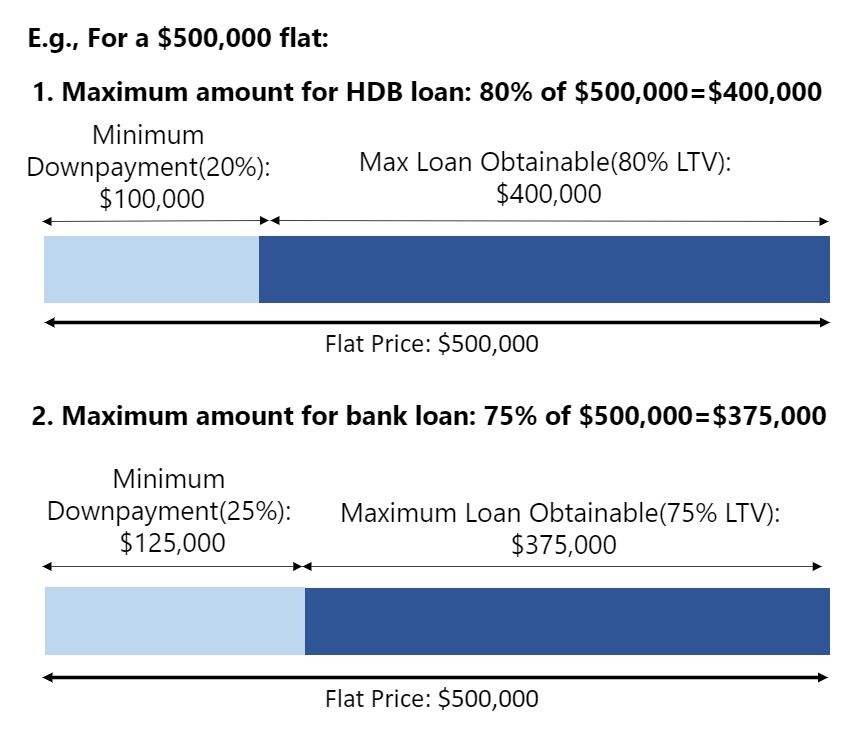

Do note that whether you buy your next flat or sell your existing one first, the Loan- to-Value limits remain the same i.e., up to 75% for both HDB loan and bank loan.

There are exciting plans to develop these urban areas into the Punggol Digital District and the Jurong Lake District, creating vibrant communities for living and working.

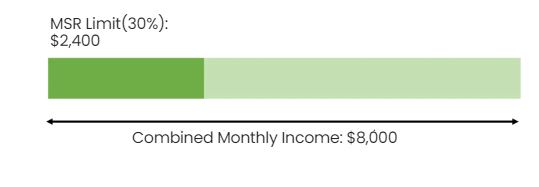

It is important to buy a home that you can afford and adopt the right mortgage repayment strategy so that you can preserve savings in your Ordinary Account for your retirement.

Are you looking to buy a new or resale HDB flat? You may be looking to upgrade to a larger (and more costly) flat for a variety of reasons. While doing so, it is important to buy a flat within your financial means and also consider your retirement needs.

Joint tenancy

If you or your co-owners decide to sell your share of the property, you would need to convert the joint tenancy to a tenancy-in-common first.

Tenancy-in-common

If you hold the property under tenancy-in-common, you are able to sell your share in the property.

Similar to a sale of the entire property, you will be also be required to refund the principal amount of CPF used and the accrued interest (P+I) based on your respective proportions.

You might need to fork out additional cash to refund to your CPF account if you use more CPF monies than your share of property. This is to ensure that CPF members who had used more CPF savings than their share of property will still have sufficient CPF savings for their retirement and housing needs.

When selling our flat, we tend to overlook the costs involved, and may overestimate our total proceeds received in cash. Besides paying off the outstanding home loan, we also have to refund the CPF principal amount used plus accrued interest, and to pay for expenses such as your agent's commission and sale-related administrative and legal fees. It is also possible not to have any cash proceeds despite selling your flat at a higher price!

Let's take a look from the context of John and Sarah to help us make a more informed choice when it comes to our own flat sale.

When John and Sarah got the keys to their HDB flat 5 years ago in 2017, they purchased it at $240,000. The breakdown of the costs is as follows:

John and Sarah sold their flat at $520,000. Upon settling the outstanding loan, making the required CPF refunds and other costs involved, they received balance sales proceeds of $234,000. The breakdown is as follows:

*Selling price includes the option monies received from buyer

When you pay your monthly instalments to HDB or banks, only the principal amount gets deducted from your outstanding loan balance. The interest is paid to HDB or banks for granting you the loan.

In this case, you may notice that despite paying approximately $59,000* in monthly instalments so far, only 56%($33,000/$59,000) goes towards paying off the principal amount. The remaining sum of $26,000 are interest expenses that do not reduce your overall loan balance.

Do take note of the above, so as to be more informed of where your monthly instalments are going to!

*$59,000 is the sum of the total monthly instalments paid over 5 years, based on a HDB loan of $216,000 and a 25 year loan tenure

While upgrading your flat, it is important to ensure that your retirement needs are taken care of as well. While it may not be top of mind when buying your home, your housing purchase has a significant impact on your ability to pursue the purposeful retirement you are dreaming of.

Find out how you can ensure your retirement needs are not compromised while upgrading your flat.