CPF contributions for platform workers born before 1 Jan 1995

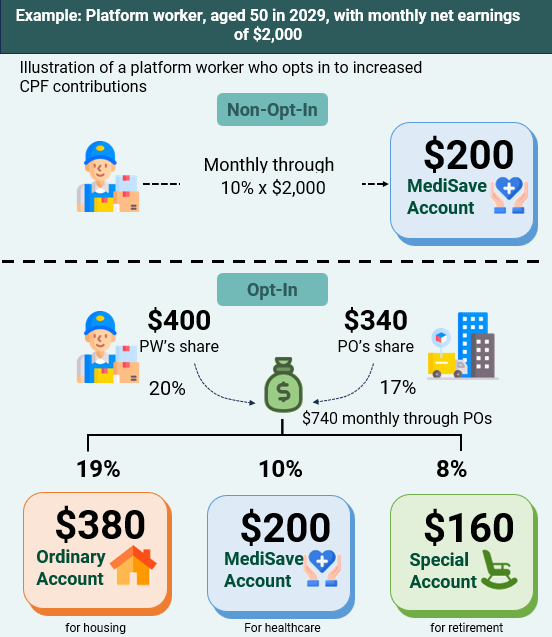

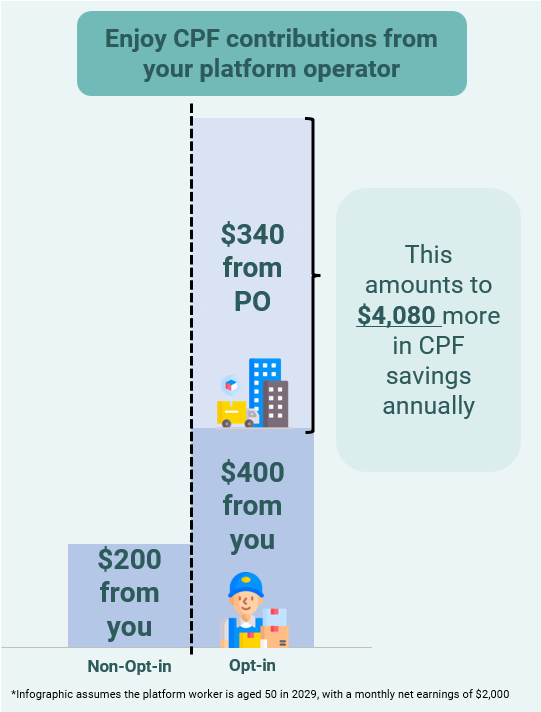

Illustration of platform worker who opts in to increased CPF contributions:

Benefits of opting in

1. You can see an increase in total earnings after factoring in additional CPF contributions from platform operators. You can receive up to 17% in monthly CPF contributions from your platform operator by 2029.

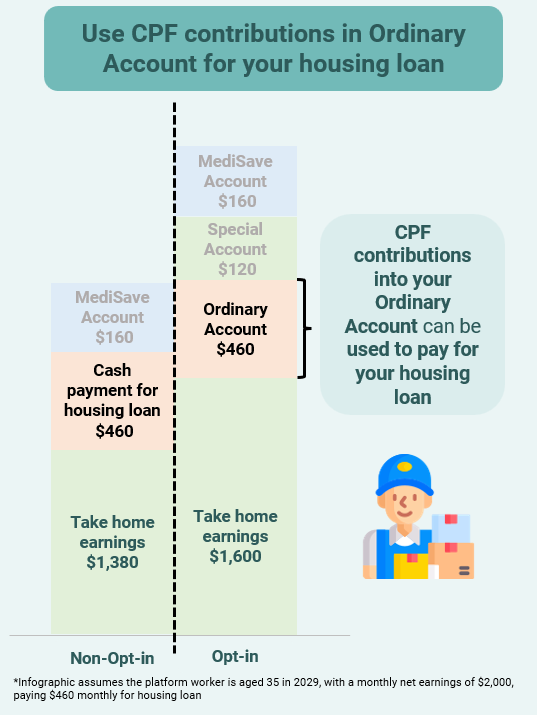

2. Your Ordinary Account savings can be used for your housing loan, freeing up your cash for other needs.