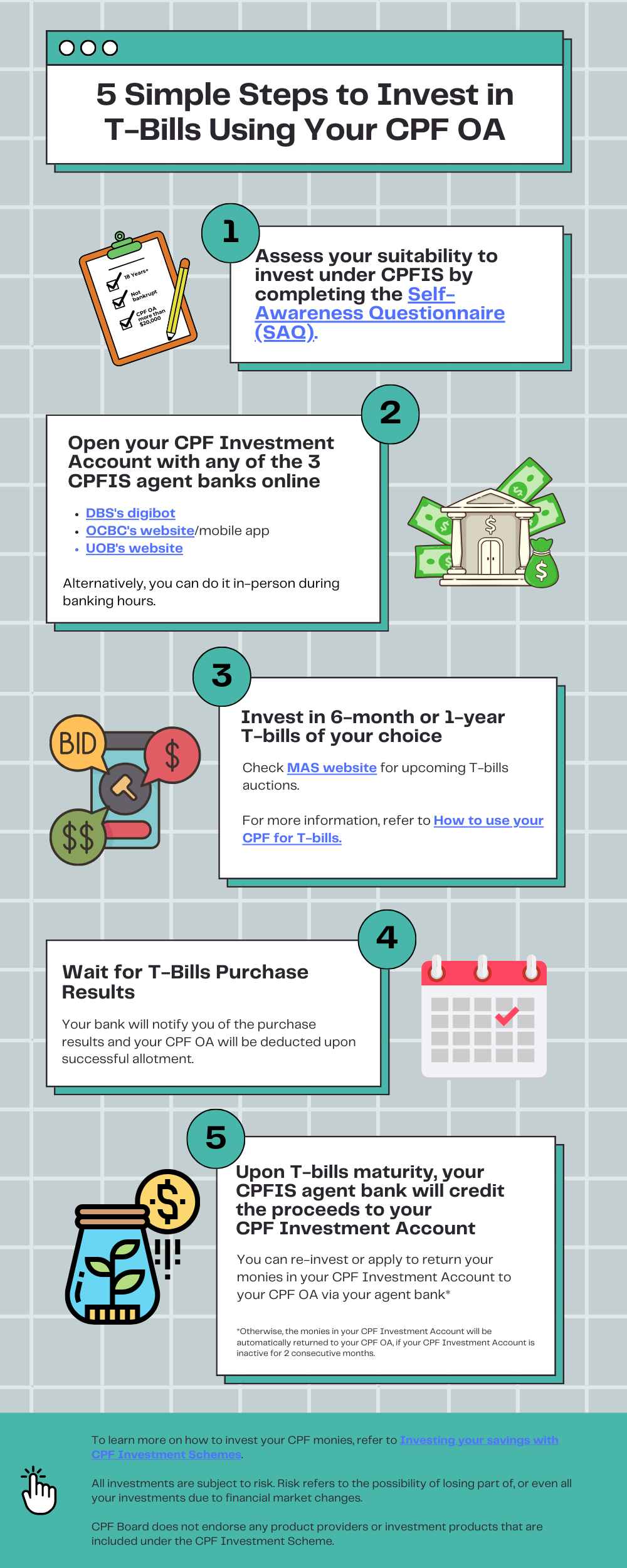

1. You need to be at least 18 years old; not an undischarged bankrupt; and have more than $20,000 in your CPF OA.

2. To start investing your CPF OA savings in T-bills, please take the following steps:

Step 2: Open CPF Investment Account (CPFIA) online with any of the 3 CPFIS agent banks –

a.

DBS's digibot (scroll to “Get started with CPFIA” and click “digibot”)

Alternatively, you may also visit any of the banks (DBS, OCBC or UOB) branches to open your CPF Investment Account.

Step 3: Invest in the T-bills of your choice. The Government issues 6-months and 1-year T-bills. You can check the

MAS website on upcoming T-bills auctions. After deciding, you can use the bank’s online services to apply for T-bills. Refer to

How to use your CPF for T-bills.

Step 4: Wait for the results of your T-bill purchase which will be available on auction date. The bank will notify you on the outcome of your T-bills purchase. You can also check the T-bills allotted to you via your CPFIA online. Your CPF OA would be deducted and transferred to your CPFIA only upon successful allotment of the T-bills.

Step 5: Upon maturity of your T-bills in 6 or 12 months (depending on the type of T-bills that you have purchased), your CPFIS agent bank will credit the proceeds to your IA. You can then take any of the following actions:

a. Re-invest in another T-bill purchase or any other investment.

b. If you do not plan to re-invest your CPF OA savings, you can apply to return the balances in the CPFIA to CPF OA to earn the CPF interest. You can do so via your CPFIS agent bank’s ATMs, internet/phone banking or over the bank counter. Click

DBS and

OCBC’s links to find out more.

c. If you do nothing, the monies in your CPFIA will be automatically returned to your CPF OA, if your CPFIA is inactive for 2 consecutive months.