5 Aug 2025

SOURCE: CPF Board

For some people, every spending decision is a conscious decision between enjoying now and saving for a more secure future. For others, they may choose to live in the moment, splurging on luxuries or lifestyle upgrades.

As retirement approaches, the possibility of insufficient savings may be compounded by Singapore’s increasing life expectancy. According to the Department of Statistics, more than 1 in 2 Singaporeans at age 65 are expected to live beyond 85. This translates to at least 20 years of managing expenses without a regular salary, a financial challenge that many may be underprepared for.

Without adequate planning of your finances, you might have to lower your expectations of your standard of living in retirement. You might even need support from elsewhere, such as family members.

This is where annuities like CPF LIFE (Lifelong Income for the Elderly) come into play. CPF LIFE helps combat the uncertainty of longevity by providing a steady stream of income regardless of how long one lives. However, the payouts are dependent on the amount one has in their Retirement Account when one starts their payouts, anytime between ages 65 and 70.

Take the Full Retirement Sum and Enhanced Retirement Sum as guideposts. In both scenarios, the savings in the Retirement Account will continue to earn interest and grow until one starts their payouts. However, the more one saves, the more one can expect to receive. For example, members turning 55 in 2025 and have set aside the Full Retirement Sum of $213,000 can expect monthly payouts of up to $1,730 at 65; members who have set aside the Enhanced Retirement Sum of $426,000 can expect higher monthly payouts of up to $3,330.

Thoughtful planning thus becomes ever more crucial if one wishes to attain their desired payouts for their retirement. We spoke to three Singaporeans in their 50s and 60s, each with different life experiences but one shared mindset: that it’s possible to plan wisely today to combat uncertainty in the future.

Planning for confidence in retirement

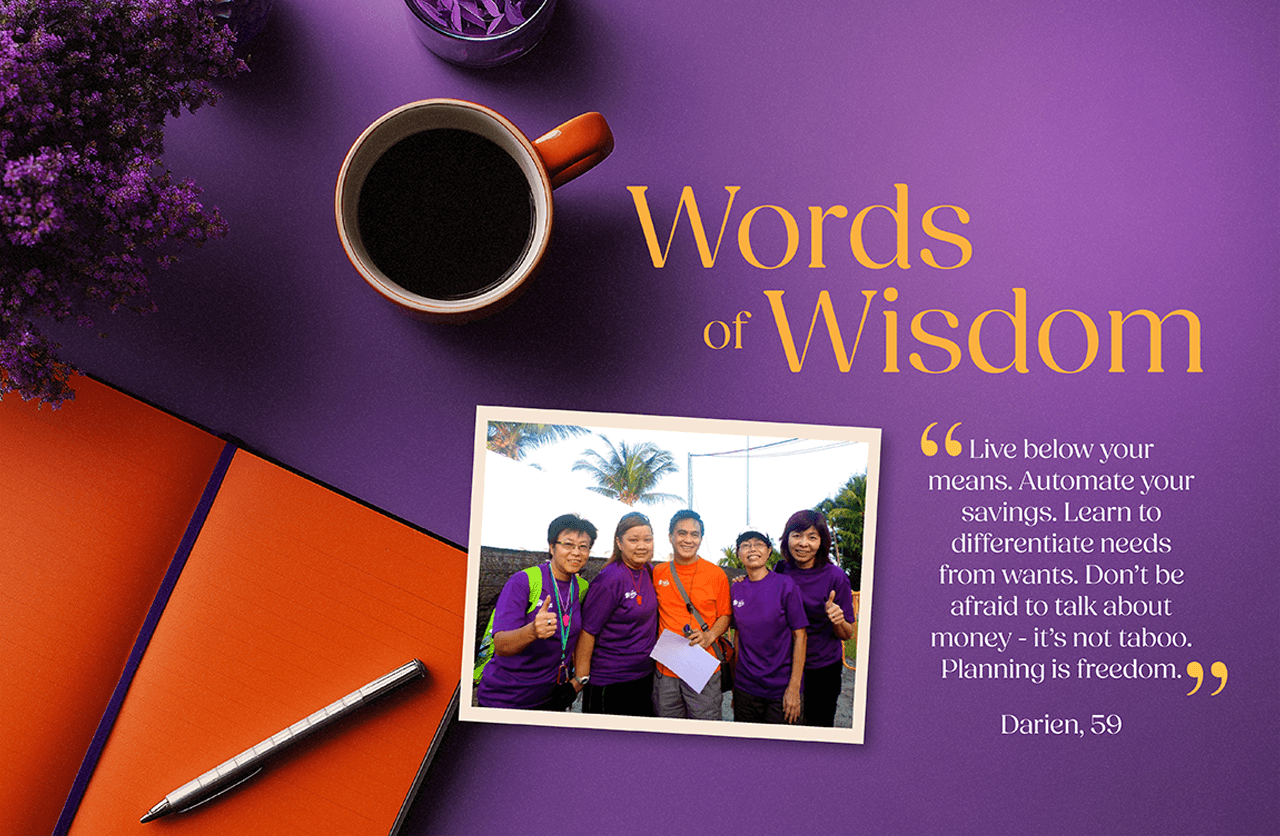

Darien Lim, 59, a senior HR manager, began planning for his retirement in his mid-40s. The turning point for him was observing how others had difficulties sustaining their retirement funds:

"I saw my parents navigate retirement without much of a plan. And I saw colleagues panic in their 60s. That’s when I realised if I don’t take charge early, I’ll feel helpless later."

Darien has since built up his CPF savings, maintained an emergency fund, and now uses the Retirement Payout Planner to simulate different scenarios for his monthly payouts, all while keeping track of and controlling his own spending:

“I believe that balancing enjoyment and saving for retirement is important. While it’s wise to be mindful of expenses and prioritise saving for the future, I don’t think it’s necessary to completely stop spending on things I enjoy. Instead, I find a sustainable balance that allows me to enjoy life now while also preparing for the future.”

But striking a good balance and having a clear plan aren’t exclusive to the present. Darien has also adjusted his retirement plans, based on changes he expects to face in the future:

“I’ve adjusted my financial goals to match each phase: leisure and light work in the first few years of retirement, stability and health needs several years after, and medical care and legacy planning when I’ve long stopped working.”

Darien believes it’s easier to achieve financial goals in retirement if one starts as early as possible, and in a steady consistent manner. To that end, he makes consistent cash top-ups to his CPF accounts, to benefit from the steady interest rates. Consistency is the principle he goes by:

“By consistently saving and budgeting, I'm able to focus on enriching experiences and giving back to the community during retirement, not just financially surviving it.”

CPF LIFE as the bedrock of his retirement

At 61, Ramanathan, a marine engineer, embodies the spirit of looking ahead. Instead of winding down his career, he's taken SkillsFuture courses in other industries to ensure he will have skills to remain employable. From volunteering with CPF Board to his aspiration of being a mentor to university students in retirement, Ramanathan’s vision is about leaving a lasting impact on the next generation and others around him.

What’s important for him is a lifestyle without financial strain. This was why Ramanathan started topping up his CPF at age 48. In line with that philosophy, he has some advice for people who have not started retirement planning, based on his own experiences and learnings:

“When you receive your salary, first keep 10% as your savings, which can be topped up to your Special Account. It’s never too late to plan for one’s retirement, and you can always start today.”

With his sights on the future, Ramanathan intends to rely on CPF LIFE as his primary retirement income. “It’s a safe bet. CPF LIFE gives me a monthly payout I can count on, so I don’t worry as much,” he said.

With CPF LIFE as the bedrock of his retirement funds, he uses the Retirement Payout Planner annually to calibrate his goals. Every year, he also tops up his account depending on his bonus and cash in hand.

This forward-thinking mindset extends to Ramanathan’s legacy and estate planning as well. He looks out for his family by making a CPF nomination to ensure his CPF savings would be distributed according to his wishes when he is no longer around. This gives him peace of mind knowing his wishes will be honoured and his loved ones will be cared for.

Ramanathan’s comprehensive approach to his retirement, from financial planning to legacy arrangements, is a powerful reminder that with careful planning, one can look forward to their golden years with confidence rather than concern. “An ideal retirement lifestyle should be of good quality, not of survival,” he said.

The mindset shift that changed everything

For Alvin Chiam, 54, a university lecturer, planning for retirement began five years ago. Not because someone told him to, but because he wanted the freedom to explore his creativity in theatre performances without being bound to a full-time job. These activities bring him joy and purpose.

Instead of chasing the "best version of everything", Alvin now saves for his retirement by cutting down on unnecessary purchases. He does so by changing the way he approaches buying items:

“The older I got, the more I realised I can just use my things for longer without constantly upgrading. When I see a newer version of an earphone that I already have, I want to buy it. But then I ask myself, do I really need this or do I just want it? That helps me realise this isn’t essential, so I don’t really need to buy it.”

Alvin also separates his income into specific accounts: daily spending and emergency funds. This simple act allows him to not only keep track of his savings, but also gives clarity on what he can spend.

This doesn’t mean he forgoes spending in favour of saving. On the contrary, Alvin believes in effective decumulation in his retirement, which is the act of drawing down on what has been saved. The choice between saving and spending is dependent on what stage of life he is in:

“At this stage of my life, saving up is more important than spending. This is so that I will continue to have enough to enjoy myself in the future.”

Alvin also utilises the Retirement Payout Planner to visualise how much payouts he will receive when he retires. Using these projections, he adjusts his current plans accordingly so as to be able to reach his desired goals.

Through thoughtful planning and strategic saving, Alvin is crafting a future where financial constraints won't dictate his choices. By building a strong financial foundation now, he's ensuring that his golden years will be defined not by what he can afford, but by what he chooses to do. For him, it’s this freedom of choice that makes all the careful planning worthwhile.

Retirement is about giving yourself choices

The older we get, the more it can feel like life is filled with uncertainties. But the truth is, you don’t have to choose between living today and planning for tomorrow. The key is striking a balance between both.

With some intentionality, clarity and CPF tools by your side, you can build a future that feels secure and a present that feels fulfilling.

As Alvin puts it best: “Saving is not about deprivation. It’s about giving yourself choices.”

Stay on track of your retirement income goals with a personalised plan from the Retirement Payout Planner. If you’re ready, why not make a cash top-up today?

Information in this article is accurate as at the date of publication.

.jpg)