5 June 2023

SOURCE: CPF Board

Audra Tan understands the importance of putting in the work for a better future. The 53-year-old who works in a managerial position believes strongly in planning ahead, and more importantly the steps she needs to take to have a secure retirement.

In this article, we explore the smart decisions that the mother of three has made in preparation for her retirement goals. This includes considering a wide array of financing options for her child’s education and how it ties into her retirement planning.

Financing her child's university education

Jolyn, Audra's daughter, enrolled in a business degree program at Nanyang Technological University (NTU) in 2022 where the course fees for the three-year program totalled to around $30,000.

As Jolyn had previously used up her Post-Secondary Education Account (PSEA) funds for her polytechnic studies, she was unable to use it for her course at NTU. After considering other financing options and other bursaries and subsidies, Jolyn took up the MOE Tuition Fee Loan (TFL) to finance her studies in NTU as it was interest-free during her course of study.

Preserving CPF savings for retirement

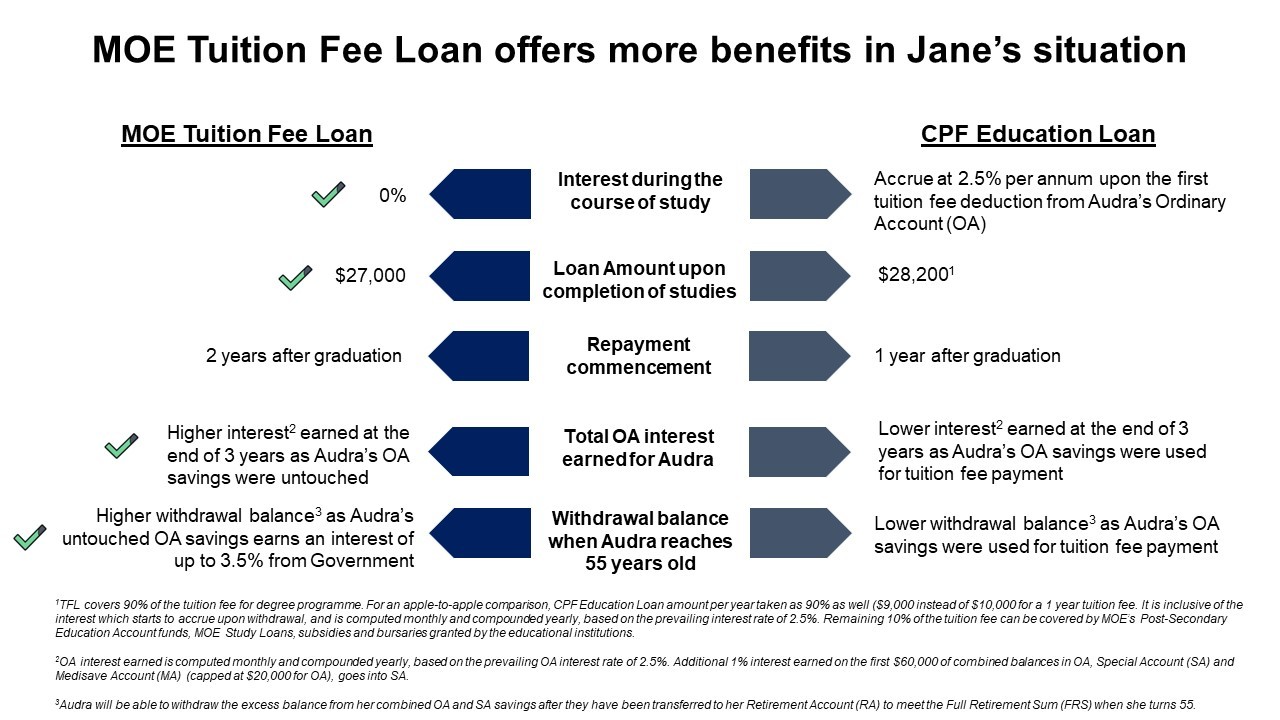

Audra had also considered the CPF Education Loan, which uses her Ordinary Account (OA) savings to pay for her child’s tuition fees. The CPF Education Loan requires her child to repay the principal amount withdrawn and the accrued interest to Audra’s CPF account one year after graduation.

However, an important thing to note is that the CPF interest of 2.5% begins to accrue once the first tuition fee is deducted from Audra's Ordinary Account. As a result, the loan amount to be repaid upon the completion of her child’s studies is higher if she uses the CPF Education Loan.

1TFL covers 90% of the tuition fee for degree programme. For direct comparison, CPF Education Loan per year is taken as 90% as well, (i.e. $9,000 instead of $10,000 for a 1-year tuition fee). It is inclusive of the interest which starts to accrue upon withdrawal, and is computed monthly and compounded yearly, based on the prevailing interest rate of 2.5%. The remaining 10% of the tuition fee can be covered by MOE’s Post-Secondary Education Account funds, MOE Study Loans, subsidies and bursaries granted by the educational institutions.

2OA interest earned is computed monthly and compounded yearly, based on the prevailing OA interest rate of 2.5%. Additional 1% interest earned on the first $60,000 of combined balances in OA, Special Account (SA) and MediSave Account (MA) (capped at $20,000 for OA), goes into SA.

3Audra will be able to withdraw the excess balance from her combined OA and SA savings after they have been transferred to her Retirement Account (RA) to meet the Full Retirement Sum (FRS) when she turns 55.

After comparing the pros and cons between the MOE TFL and CPF Education Loan, Audra decided on the former as it is interest-free during her child’s course of study and offers more benefits.

This way, Audra can leave her untouched CPF savings to earn more interest in her Ordinary Account during the three years that her daughter is in university. When Audra reaches age 55 in a few years’ time, she will also be eligible to withdraw her CPF to pay off the MOE TFL fully and will not need to pay any interest on the MOE TFL.

This also frees up room for her in the present to have additional cash on hand, which she plans to use for some stable investments.

Planning for retirement – taking the longer view

By financing her child's university education without using her CPF savings, Audra’s decision complements her retirement planning. She recognises that preserving her CPF savings would make it easier for her to achieve a stronger safety net in retirement.

Besides that, Audra has also realised that a good retirement is about having the peace of mind to do what she values in this important stage of her life. Preparing for her retirement isn't just about finances - it's also about being mentally and physically ready as well. That’s why she hits the gym regularly to maintain her health and well-being, serving her well in the years to come.

With a solid retirement plan in place, Audra looks forward to travelling the world and making unforgettable memories with her family after she retires.

Enjoying your golden years in retirement

Like Audra, those of us at a similar stage of life might be wondering what lies ahead for us in retirement. It may seem logical to use your CPF savings for your child’s education, but there are options such as the MOE TFL that enable you to enjoy the best of both worlds – to finance your child’s education without compromising your own retirement goals.

Review your finances today and get started with the CPF planner!

Information in this article is accurate as at the date of publication.