13 September 2023

SOURCE: SG Budget Babe

You’ve seen my plan for building up my retirement income (here), and you’ve sent in the questions. In this article, I dive deeper into how I intend to get paid $5,000 per month in retirement from my CPF funds alone, as well as the steps I’m currently taking to get there.

Let’s start with a quick recap – when we retire, most of us will still have expenses to pay for. I’ve categorised them as follows:

- Fixed expenses (cost of living)

- Travel expenses to overseas countries

- Unexpected expenses (e.g. medical bills, replacement costs for home appliances due to prolonged use, etc)

The amount we will need in retirement all boils down to how much our expenses add up to. If you asked me, the best solution involves planning for the expected costs of living (my needs) and travel expenses (my wants), while I rely on insurance or my emergency funds for the unexpected expenses.

In securing the funds for my cost of living, I look to my guaranteed retirement pot i.e. my CPF savings, which can and will be used to primarily cover my fixed living expenses.

Fun fact: A few years ago (in 2017), I did an estimate here on this blog about how much my desired retirement lifestyle (as a single in my 20s) may cost me when I turn 65, which worked out to be S$1,800 – S$3,000 then.

Things have changed since then. Inflation has gone up, and so have my spending patterns – I now spend more when dining out and I’ve also increased my expenses on beauty services and vanity products.

So here are my latest estimates (based on today’s prices) instead:

Essential living expenses (per month): S$2,900

Types of Expenses |

Category |

Today |

Daily necessities |

Food and groceries - household |

$900 |

Utilities (electricity & water) - household |

$300 |

|

Public transport – self |

$200 |

|

Telco & internet – self |

$200 |

|

Self-care

|

Dining out |

$600 |

Movies |

$100 |

|

Shopping |

$300 |

|

[New!] Beauty services |

$300 |

You may have noticed that not only did I increase the numbers for each item, but I have also added 1 new category vs. my original pre-kids version. For example:

- Dining out: Back in 2017, $30 used to be sufficient for me for a meal and drink at a nice café with friends. In my retirement years I’d like to be able to continue the tradition of dining out with my children. I also do not want them to feel obligated to foot the bill. Factoring the rise in cost, I’ve estimated S$600 for this category for now.

- Beauty services: In my 20s, I didn’t care too much about skincare or beauty supplements. However, upon entering my 30s, it takes a lot more effort for me to maintain my looks and health! I now take multi-vitamins, collagen supplements, probiotics and fibre regularly.

By the time I am in my 60s, my children would be in their mid-30s and are likely to be working for some time so I won’t have to worry about setting aside money in my retirement for their university or tuition fees.

Note: if you still need to financially support your children’s education in retirement, be sure to factor that into your financial plans!

And of course, if money isn’t a problem, I’d also love to travel and explore the world in my retirement years. In the most ideal situation, this would be my travel plans:

IDEAL Leisure expenses (per year): ~S$16,000

A 1-week vacation in Asia each quarter |

$1,500 x 4 = $6,000 |

A 2-week vacation out of Asia once a year |

$10,000 |

I’m mindful that this plan is quite “luxurious” and that over time, it will cost more. If in the future, there is a need to be more prudent, this will be the category I’ll review.

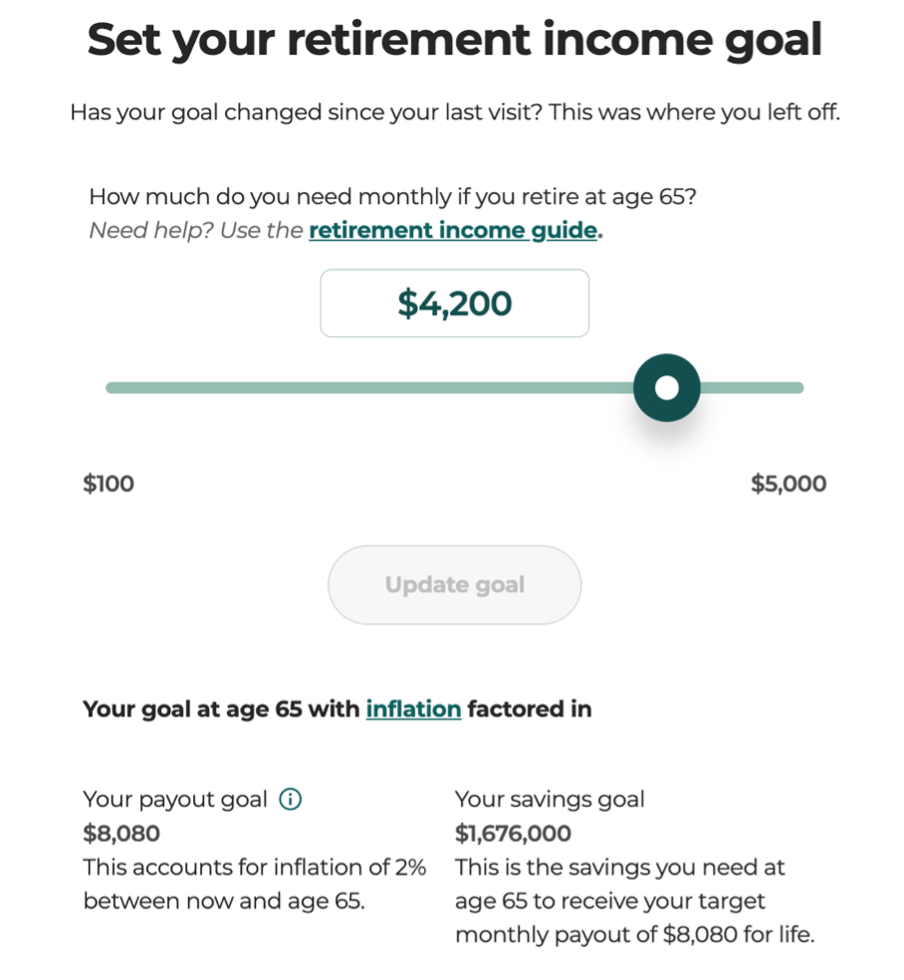

Adding both categories up will amount to $50,800 of expenses in a year, or approximately S$4,200 a month.

Based on these estimates, I should thus plan to have at least S$4,200 / month in retirement if I want to enjoy such a lifestyle (one that includes 5 trips abroad each year). This is based on today’s dollars, which means if I assume a 2% yearly inflation rate between now until I hit age 65, it translates to at least $8,000 a month in retirement.

Hmm, that’s a lot.

What if I took travel out of the equation, and used the $2,900 projected figure for my estimated cost of living instead?

With that, the figure now changes to $5,500 per month in retirement when I turn 65. Sounds more realistic, so let’s work with that first.

The next question is, can I get to that with my CPF savings?

To answer this question, I used the CPF planner – retirement income (“CPF Planner”) to tell me whether I’m on track.

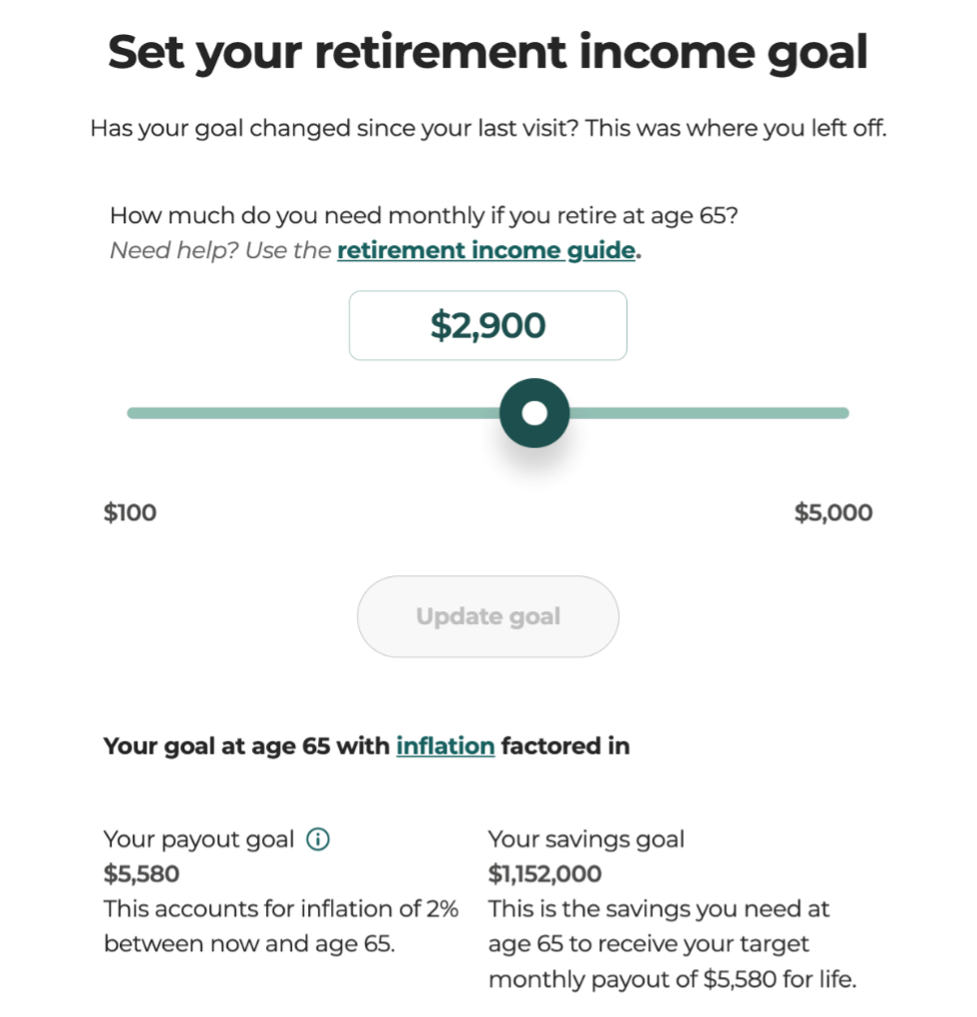

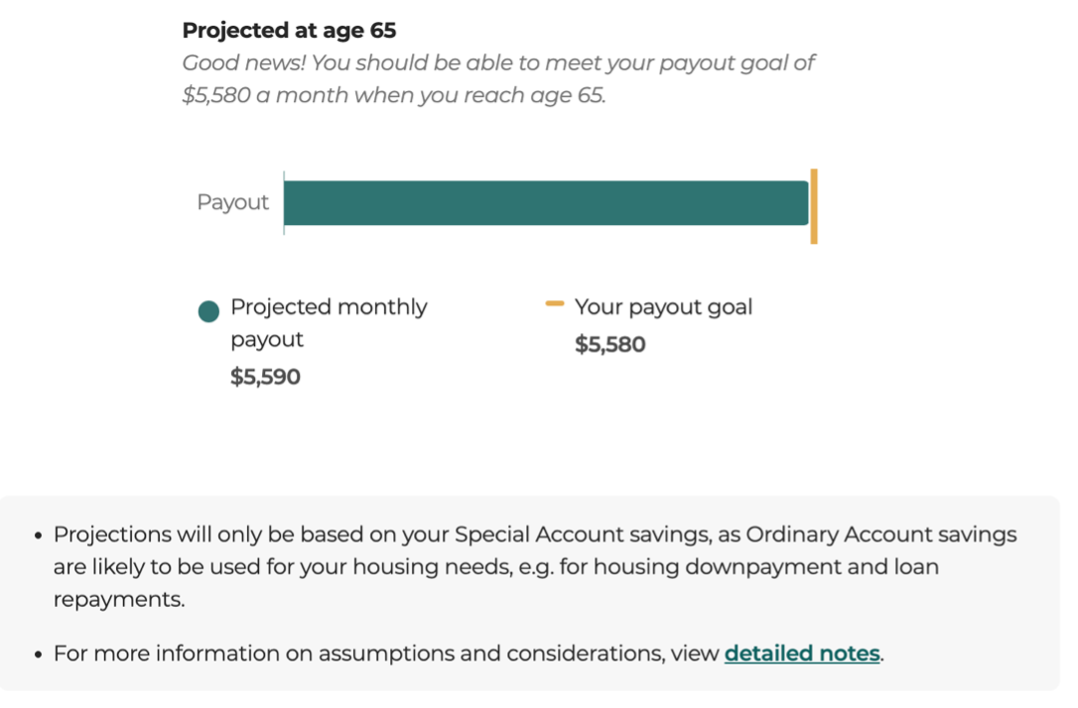

I keyed in my estimated expenses of $2,900 (based on today’s dollars) into the calculator, and with inflation factored, it amounts to $5,580. To achieve that payout goal, I was informed that I needed to work towards a savings goal of $1,152,000.

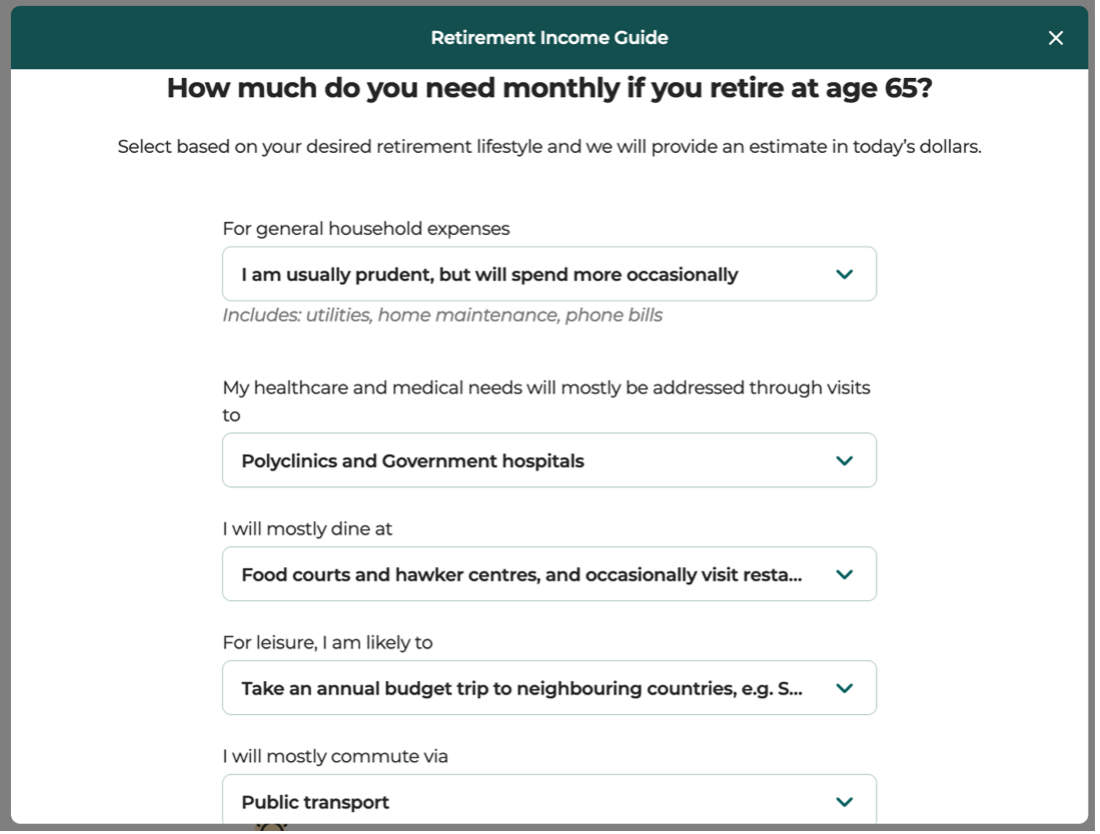

Sidenote: If you’ve no idea how much you’ll need, you can estimate by clicking on the “retirement income guide” (see screenshot below). It will guide you to derive a retirement lifestyle that you prefer.

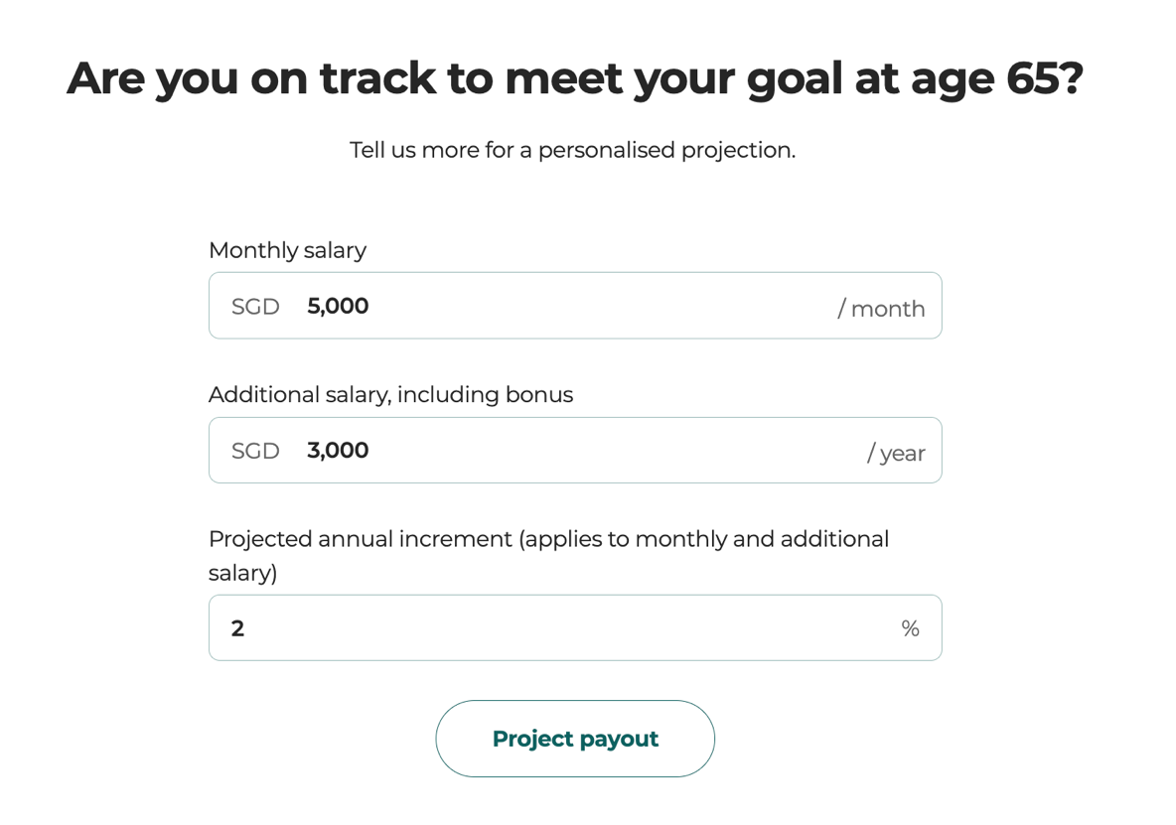

I then proceeded to input my estimated employment income (during my working years from now until age 65) so that the calculator can project whether my CPF contributions will be sufficient to get me to my goal.

I’ve used $5,000 as a benchmark, which was how much I was drawing in my last job. Although I’ve never received a bonus in my entire working life (yes, no 13th month bonus either), I’ll assume that my lucky stars will help me find a future boss who will give me a S$3,000 yearly bonus each year…otherwise, I’ll simply have to find other means to get this for myself (such as through a side hustle, etc).

I’ve projected a 2% annual increment in line with historical inflation rates, although to be honest, the only times I’ve gotten a salary increment was when I switched to another company.

Thankfully, the CPF planner projected that I should be able to meet my payout goal – based on my current CPF savings. For those of you who are wondering, my Special Account currently has >90% of today’s Full Retirement Sum (2023).

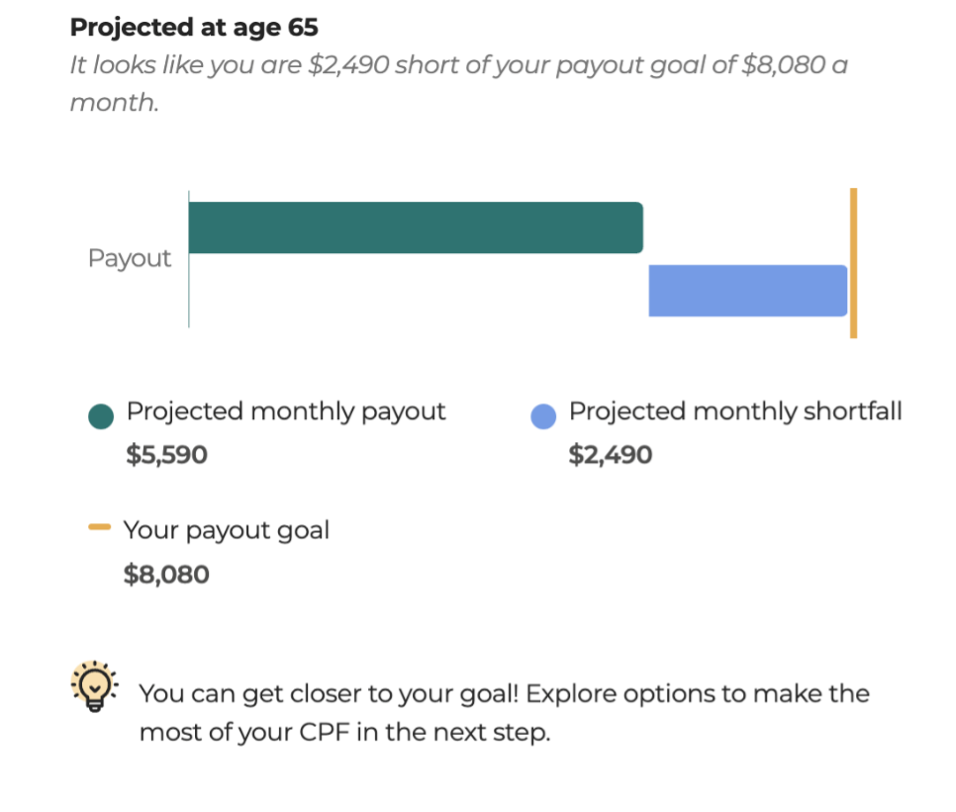

Ok, what about if I were to account for my desired travel lifestyle expenses in this calculation too?

Using S$4,200 a month (in today’s dollars), the calculator informed that my CPF savings would be insufficient in meeting my desired retirement lifestyle.

So what will it take for me to meet my dream retirement goals?

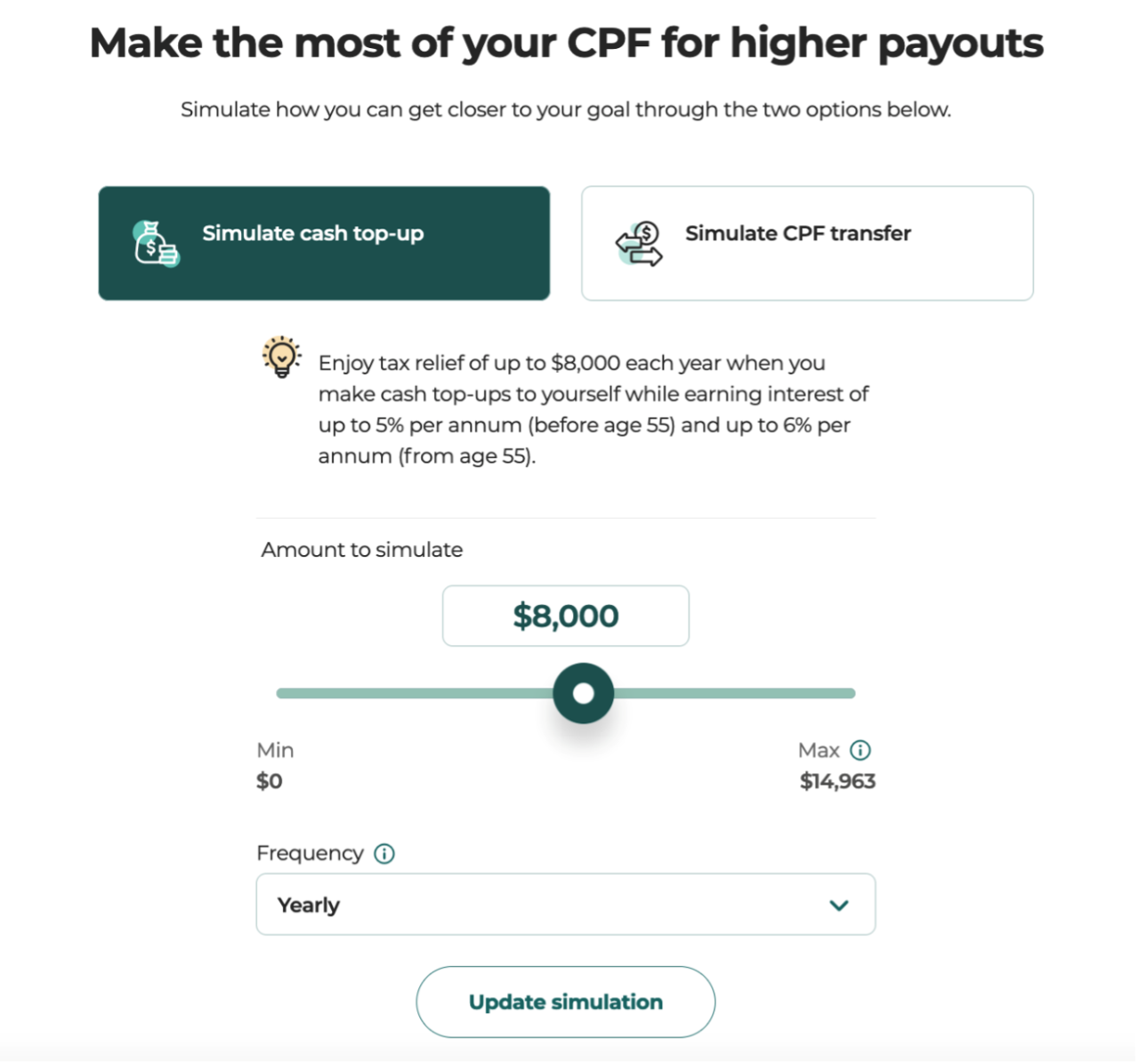

Well, this is where the CPF planner can simulate scenarios should we decide to take active steps to work towards it, for example, if we were to transfer our Ordinary Account (OA) funds to our Special Account (SA), or if we were to make a cash top-up via the Retirement Sum Topping Up (RSTU) scheme.

Sidenote: I’ve already been periodically transferring my OA funds into my SA since my mid-20s, so there are very little funds in my OA (the amount I’ve kept in there is mostly for liquidity purposes i.e. sufficient only to pay for 12 months of our housing loan). For me, moving all of the funds out will not make much of a difference to my retirement plan, so I’ll need to do a cash top-up instead.

Did you know that you can obtain tax reliefs when you choose to top up your CPF? The sum has since increased to $8,000 in 2022 (from a previous cap of S$7,000).

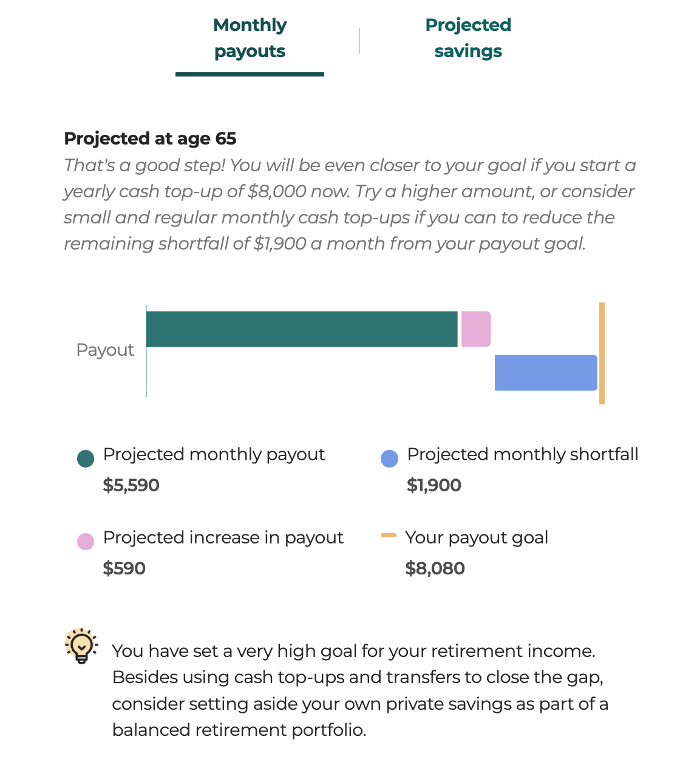

See my projection below:

Do note that the topping up projections are subject to prevailing top-up limits. If you are earning a higher income and/or close to the current FRS (like me), even a $8,000 voluntary cash top-up annually may not go through in full each year.

Thus, even if I were to continue my current practice of topping up S$8,000 every year, it will not get me closer to financing my 5x yearly travel aspirations. I will need to either adjust my expectations or fund my travels from other sources of retirement income.

Hence, the CPF planner makes it clear that while my current CPF savings are sufficient to finance my basic retirement needs, it will not be enough to fully finance the extent of my travel aspirations in retirement – I will need to fund that from something other than my CPF as well.

Which is why I’m working hard on building up additional sources of retirement income – stay tuned to my blog for more details on how.

Using the CPF planner, I can relax, knowing that my CPF savings will be sufficient to pay for my fixed expenses in my retirement years.

But if I were to hope for my CPF funds to pay for my 5 travel trips a year, that will be too much. With that extent of travel, my current CPF savings won’t be enough to fund my desired travel lifestyle in my retirement years. Even if I were to make a voluntary cash top-up of S$8,000 every year without fail, it will still be insufficient.

The tool then goes on to recommend that I also use my private savings as part of a balanced retirement portfolio, which I fully agree with.

Of course, there are several limitations to this tool, including:

- A 2% inflation rate is applied to the initial retirement income goal that you input (in today’s dollars) to compute your payout goal at age 65.

- If you did not input your own number for that page, but used the projected number based on the retirement income guide instead, you should note that the retirement lifestyle choices provided are based on expenditure from the Household Expenditure Survey 2017/18. This may or may not be an accurate reflection of your own spending levels and habits.

- Since projections are based on the salary-related details you provided, the tool assumes that you remain employed throughout the projection period. In the event of any prolonged unemployment, your end results may vary from the initial estimations that you obtained from the planner. For the self-employed or gig workers, or anyone whose salary fluctuates considerably, the accuracy of the estimated projection may vary over a prolonged period of time.

In time to come, I hope to see the tool being refreshed with options for us to play around with inflation rates – especially now that inflation has remained far above the 2% rate for almost 2 years now.

After all, as a salaried Singaporean worker, your CPF is likely going to be your first, if not your biggest, retirement pot. It’ll be worthwhile to make sure you optimise your CPF for the highest returns (such as making voluntary cash top-ups and transferring your Ordinary Account funds into your Special Account) and to work towards your preferred payout to meet your retirement goals.

Go ahead, check whether your CPF is on track here!

Disclosure: This article is written in collaboration with CPF Board, who has a nifty CPF planner – retirement income tool to help Singaporeans visualise and plan for their retirement.