21 Mar 2023

SOURCE: yonghui.sg

Making an LPA (Lasting Power of Attorney) was something that has been on my mind for a long time but I kept procrastinating because the process seemed so tedious to me.

So I am really glad that I finally completed it this month, thanks to the online application process launched by the Office of Public Guardian (OPG) in Nov 2022!

In this post, I share about my personal experience going through the LPA application online and what to take note of. Hope this will come in handy if you have been thinking of doing your LPA but not yet taken action or if you are not yet aware about LPA.

It’s a legal instrument which allows a person (Donor) to voluntarily appoint one or more persons (Donee (s)) to make decisions and act on his/her behalf should he/she lose mental capacity one day.

Donee (s) can be appointed to act in 2 main areas

- Personal Welfare e.g living arrangements, medical care and daily care decisions and/or

- Property & Affairs e.g accessing the donor’s bank accounts to pay for his/her care, dealing with CPF matters, handling property and making investments.

I have heard and read enough stories of people who lost their mental capacity due to a sudden accident, illness e.g stroke or old age due to dementia.

Without an LPA, my family members are not automatically given the right to make legal decisions on my behalf, should I lose my mental capacity one day.

In order to access my savings for e.g. medical care and caregiving expenses, they might have to go through the tedious process of applying to the Court to be appointed as my deputy. All this takes time, money and can be very stressful for my family members to go through, while they worry about taking care of me.

Life is unpredictable and I always believe in taking care of myself for my family.

This includes making the necessary preparations and financial provisions while I can, to make it easier for my family should something happen.

I also made sure the LPA has been done for my elderly mum and parents-in-law, so that they can decide whom they wish to make decisions for them while they are of sound mind. This will also help prevent any potential disputes over whom to make decisions on their behalf.

My mother-in-law even commented that LPA seems even more important than a will since it directly affects her personal welfare while she is alive.

A will kicks in only upon a person’s death, whereas an LPA comes into effect when a person is alive but has lost mental capacity. Both a will and LPA forms part of advance care planning and is important to set up.

Note that there are 2 types of LPA

- Form 1 (simple one to grant general powers)

- Form 2 (more customised and needs to be drafted by a lawyer)

Form 1 works for general cases and it can be done online via the OPG portal.

Good news, the registration fee of $75 for Singaporean citizens applying for LPA Form 1 is waived until 31st March 2026, so wait no longer! (that was what propel me to get it done quickly too ;)

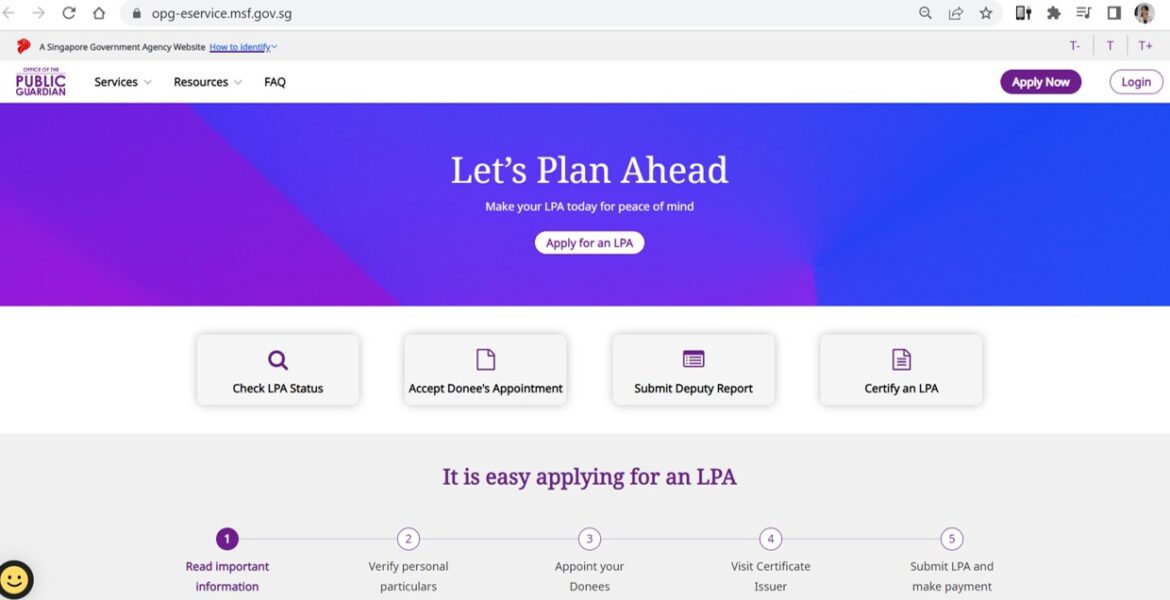

Step 1 –(Online) Complete the LPA application form at the OPG portal

https://opg-eservice.msf.gov.sg/

Simply log in using your Singpass and follow the step by step process

Here’s what you need to decide and prepare to enter in the system

a) Donee (s)

Who will be your donee(s) to decide on your personal welfare and financial affairs?

You can choose to have a single donee or more than one donee. If you choose to have more than one donee, you need to indicate whether they will make decisions

- Jointly – meaning every decision they will make on your behalf should be agreed upon by both, and it has to be decided together.

- Jointly and severally – This means your donees can decide together or either of them can make the decision.

You can also set a replacement donee in case the primary donee is unable to fulfill the duties.

b) Personal particulars of donee

Prepare your donee’s name, NRIC and email address to enter in the system.

c) Answer 3 questions on the powers you decide to offer to your donee(s)

MSF has actually come up with a very clear and detailed video running through the various steps for the online process here

Step 2 – (Online) Make sure your donees accept their appointment

Once you submit your LPA application, your donees will receive notification through Singpass to login to OPG to accept their appointment.

Step 3 – (In person) Visit a Certificate Issuer

A certificate issuer can be accredited medical practitioners, practising lawyers or registered psychiatrists. You can find a certificate issuer near your area via this link https://opg-eservice.msf.gov.sg/LPA/CIMapService.aspx

I called several clinics around my area to enquire on the certification and found that their charges range from $50 to as high as $200! Most clinics require you to make an appointment beforehand and some clinics are fully booked into April.

Some medical practitioners also require both the doner and donees to be present for the process while the medical practitioner I got mine done at, only required the doner to be present. The entire certification process was smooth and conveniently done through Singpass.

Once the LPA is certified, it will be submitted directly to OPG for registration. You will be notified via SMS/email once the digital LPA is registered and accepted.

Hope the above guide is helpful to you in setting up the LPA for yourself and your family members! I highly encourage everyone to get the LPA done to safeguard your interests and avoid unnecessary legal hassle for your family.

This article was first published on yonghui.sg

Information presented is accurate as of the date of publication.