18 Nov 2022

SOURCE: CPF Board

As the saying goes, ‘home is where the heart is’. Your home is not just there to shelter you from the weather—it also allows you to rest up and recharge after a long day. This is true even as you reach your golden years. Thus, it’s important to ensure that your home is comfortable, and is a place that allows you to relax.

With the recent property cooling measures, it’s more important than ever to work out your housing budget. Is buying a new place for your retirement the only option? How about looking at ways to refresh and maintain your humble abode, to find one that might better suit your new retirement lifestyle? Let’s look at some options available:

1. Declutter your private space

Sometimes, less is more. Just like how thinking about too many things can cause mental fatigue, having too many items in your home can be problematic too. Apart from being a fire hazard, they may attract pests such as mosquitos and cockroaches and can also affect your mental wellbeing.

Moreover, it is particularly important, as you age, that you have a home that enables you to move around freely.

How can you effectively declutter? Terms such as ‘sparking joy’ or ‘editing your home’ might seem like social media trends that have come and gone, but they point to a truism in life. It is important to think about how you might want to organise your home in a way that suits how you want to live, including your retirement lifestyle. The simplest way is to start with sorting out your items into one of three categories: Short-term consumables, lasting items and disposables.

Short-term consumables

Short-term consumables are items that should be used within the short term, such as newspapers and magazines. After being read once become outdated and can be thrown away. These items should not be kept for future use as their usage and contents may become outdated with time.

Disposables

Disposables are items that no longer serve a purpose. Such items could include old electronics that are barely functional. The latter may still work to some degree, but it can fall apart or fail at any time, thereby exposing yourself to danger when it does. Furthermore, if the item does not fulfill an immediate or future need, or if the need can be covered by another item, then it is considered a disposable and can be thrown out or even upcycled.

Lasting items

Items in this category have crucial functions in your day-to-day life, such as washing machines, clothing irons and medical devices such as sphygmomanometers (otherwise known as blood pressure cuffs) These items are not one-use, but may not always be needed in the near future.

2. Renovating your home!

Another way to upkeep your current home would be to renovate it for a fresh look. Starting the whole renovation process can be daunting, especially if the last time you renovated was when you first bought a home. If you have been staying in your current home for many years, you might also be overwhelmed by the overload of information on the latest interior design trends as well—such as Japandi or Modern Luxe.

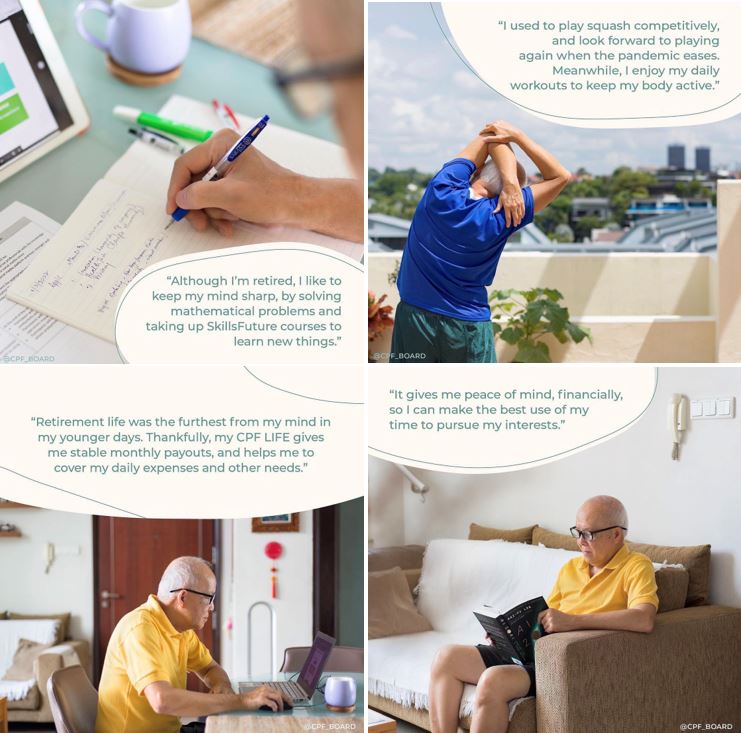

Regardless of what design concept you choose, the core of it is that managing your budget is crucial. This does not mean compromising on quality though! It does not always take expensive furniture to make a home look better. Instead, consider other ways such as upcycling your furniture to refresh the look of your house’s interior. Sometimes, a fresh coat of paint in a new colour can also be all you need to refresh the look of your home. What matters the most is creating a comfortable atmosphere in your home! As retiree Jeffrey Ho puts it:

Here are some tips from him on staying active and achieving peace of mind in retirement:

If you’re keen to find out more, you can read Mr Ho’s story here.

3. Invest in home appliances that can help you reduce your home maintenance costs in the long run!

Wanting your home to look better is natural, but utility and cost are proper concerns as well. Hence, when considering how to spend your money on home maintenance, ask your yourself, is it necessary to change your sofa when your current one works well? Would the money be better spent investing in something more useful, such as a water-saving washing machine? In the latter’s case, power saving appliances can even result in more money saved in the long run, as it reduces your utilities bill each month.

If after considering the options above, you still prefer to buy a new home, do remember to plan your housing budget in tandem with your retirement nest egg. If you find yourself in a situation where you might still need to continue using your CPF savings to pay for your mortgage beyond the age of 55, remember to apply to reserve your Ordinary Account savings before age 55 in order to continue using them.

Of course, do not forget that your OA savings form part of your retirement income too! Check out this handy home ownership dashboard to stay on top of your housing finances.

At the end of the day, a home is a haven for yourself and your loved ones. As such, it should be protected and cherished. However, that doesn’t mean your home needs to be unchanging. Instead, just like managing your finances, it’s about making a consistent effort to maintain your house so that you can transit into retirement comfortably. Regardless of whether you choose to buy a new home for retirement, or plan to stay in your current place for years to come, continuing to plan and review your housing finances is never a bad idea. This way, you can make the most of your home and retirement savings at the same time!

Information in this article is accurate as at the date of publication.