22 December 2023

SOURCE: Beansprout

What happened?

Every year as December rolls around, I sit down to do a year-end review of my finances. Amid year-end festivities, I make it a point to set aside a couple of weekends to check in on my financial health and set goals for the new year.

I’ve been doing this since my mid-20s. Back then, my only goal was to save as much money as I could and grow in my career.

But as the years went by, my goals evolved from “just earn and save more money” to more concrete life goals I wanted to achieve.

As a product designer in my early 30s, I have short-term goals like travelling a couple of times a year to Japan or Korea and having a dream wedding, mid-term goals like owning a home, having kids, and taking a career break in my 40s, and long-term goals like retiring comfortably.

But financial success isn't just about setting goals; it's about understanding where you stand and crafting a financial plan that’s aspirational and attainable.

That’s why, I'm approaching my financial future with a strategic mindset this year.

Here are the 5 key areas that I’m honing in on and examining, to lay the right foundation for a robust financial future.

#1 - Taking stock of my safety net and savings funds

Reviewing my finances often feels daunting at first, but I start by tackling the easiest task – checking my emergency fund. Call it the unsung hero of personal finance; this safety net stash often gets overlooked.

In my younger years, I brushed off the importance of an emergency fund, thinking investing was the real Most Valuable Player (MVP).

Oh, how wrong I was!

Life threw a curveball my way when I got laid off from my job during the pandemic. And because, at the time, I had invested a sizeable chunk of my savings, I scrambled to liquidate my investments to cover my living expenses.

Lesson learned.

When I found employment again, I saved 50% of my income every month to build up my emergency fund within a year. It took a lot of discipline, I had to be frugal and live on the cheap for that year because I wanted to have that financial security as soon as possible.

With a solid six months' worth of living expenses saved up, I've now got a buffer for life’s surprises.

In my year-end review, I prioritise replenishing this fund before funnelling money into other goals.

And in this era of high inflation, being prepared for unexpected expenses, from something as small as needing to replace your phone suddenly to life-changing events like getting retrenched from your job, is non-negotiable.

I also scrutinise my savings accounts. Are they working as hard as I do?

Particularly, I'm eyeing my travel fund, wedding fund, and the cash I’m saving for my home purchase and renovation as banks change their interest rates and requirements all the time and I find myself losing track of whether my funds are earning a decent interest in these accounts.

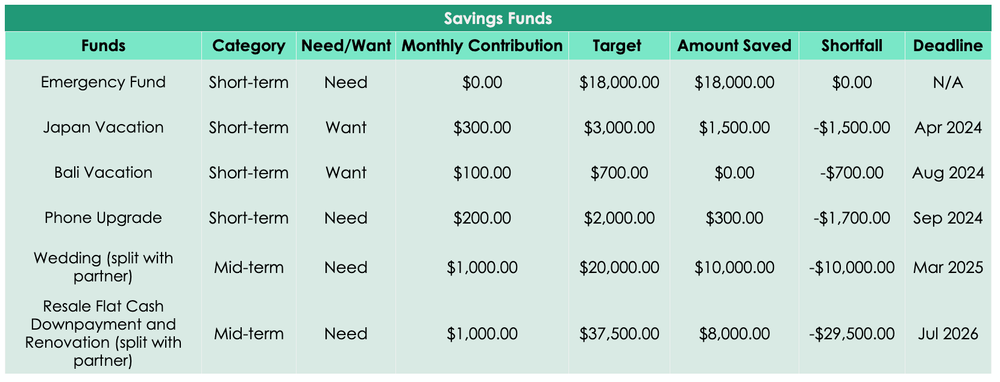

Looking ahead to the next year, I'm setting clear savings intentions – in my budget, I set a fixed monthly amount to contribute to my various savings funds.

#2 - A health check on insurance coverage

Next up on my checklist: Am I over-covered? It's a balancing act – not too much, not too little. No one wants to be over-insured, shelling out for coverage they don't need. Simultaneously, I don’t want to be caught short in a health-related crisis either.

As I don’t have any dependents yet, my main objective right now is to ensure that my medical needs and my own living expenses are taken care of if I am unable to work because of an illness or accident.

Here are some general rules of thumb when it comes to insurance protection:

- I make sure that I spend no more than 15% of my annual income on insurance protection

- Coverage typically should cover 9 times my gross annual income for death and total and severe disability and 4 times my annual income for critical illness

As MediShield Life (MSHL) already provides lifelong protection against large medical bills and CareShield Life provides monthly cash payouts in the event of severe disability, both plans complement each other to provide a basic financial safety net.

Since MSHL is generally sufficient for subsidised treatments in public hospitals, I look at whether my existing Integrated Shield Plan (IPs), critical illness and personal accident plans provide additional coverage.

As IP premiums tend to increase significantly with age and could be up to 5 times of MSHL's premiums, I need to be strategic to ensure optimal coverage.

This means comparing the various plans available in the market to ensure that I have the best deal, and making sure there are no gaps or overlaps in my coverage. I should only buy plans with premiums that I can afford, even in old age even though I can use MediSave up to the Additional Withdrawal Limits to pay for my healthcare expenses.

#3 - Checking the blueprint for my home purchase

Next, I review the goal I want to achieve in the next 5 years – owning a home.

My partner and I are planning to get a 4-room resale flat near where my parents live. The cost of such a flat currently goes for around $600,000.

As we are planning to pay a portion of our home down payment with cash, we have been setting aside some money in our down payment fund I mentioned earlier.

But saving up for a home down payment is only one part of the equation.

There are other costs that I need to factor into my budget once we do get our dream home. This includes mortgage payments, stamp duties, renovation costs, furnishing, and other home maintenance costs.

Armed with a healthy dose of pragmatism, there is one question I need to answer – can I realistically afford the home I want for years to come?

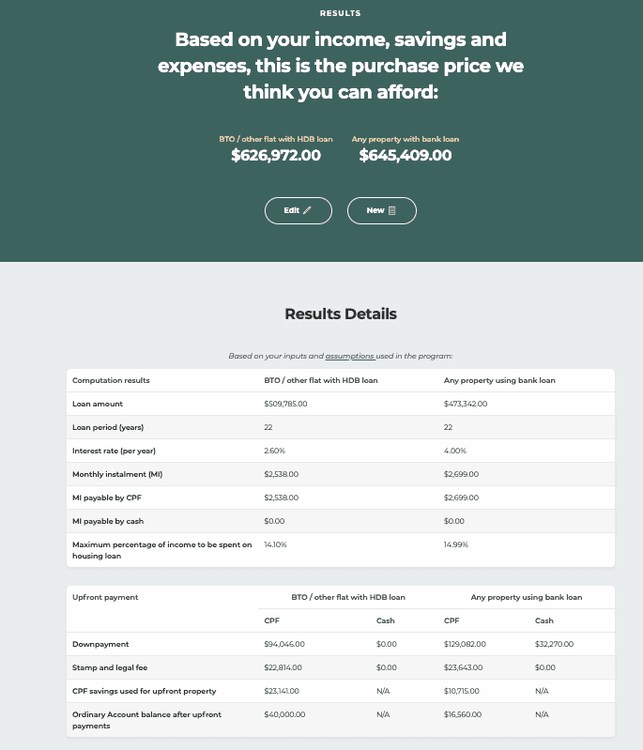

To answer that question, I use the home purchase planner to estimate the most suitable property price and home loan amount based on my current income, expenses, and savings.

Instead of manually filling in the details, I can retrieve my data through MyInfo and SGFinDex to populate the fields in the calculator.

Source: CPF website

From the results, I can estimate how much I’ll need to save for my home down payment and other costs like stamp duty and legal fees.

Besides calculating my home affordability, there are other financial guidelines I can follow to ensure that I’m ready for a home:

- Ensure my future monthly instalment doesn’t exceed 25% of my monthly income.

- Ensure that the property purchase price doesn’t exceed 5 years' worth of my partner’s and my combined annual income.

- Keep a buffer of at least 6 months of monthly instalments in my CPF Ordinary Account (OA) in case I get laid off again.

- Ensure the monthly instalments are less than my monthly OA contributions.

Following these guidelines and reviewing them regularly will ensure that we can comfortably afford our home.

#4 - Future-proofing my retirement

Retirement always seems so far away. Yet I know it's crucial to assess my retirement readiness in my financial review now because the earlier I start planning, the easier it is to build up my retirement savings and take advantage of compound interest.

Of course, to know how to plan for retirement, I need to know how much I’ll need when I retire in my 60s.

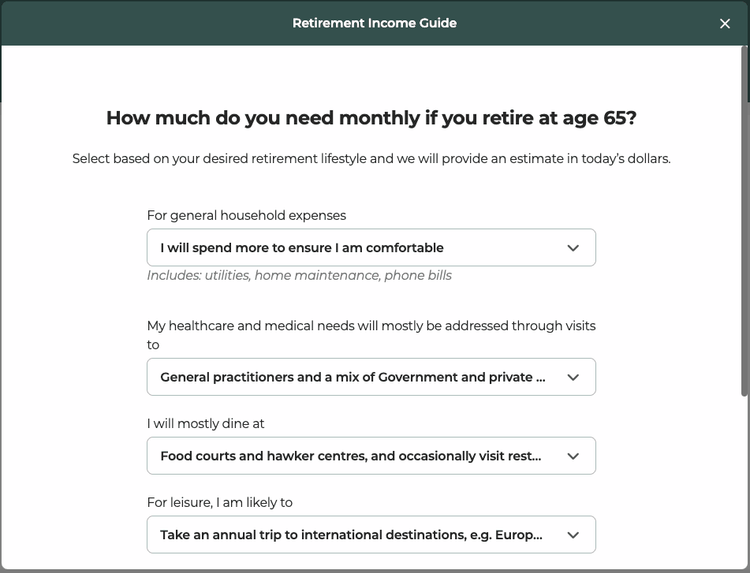

This number is not easy to predict in your 30s, but there are a few factors I’m considering: daily living expenses; medical, supplements, and long-term care expenses; and money for international travel at least twice a year, among other things.

Once I understand the lifestyle I want, then I can quantify that into a tangible retirement sum.

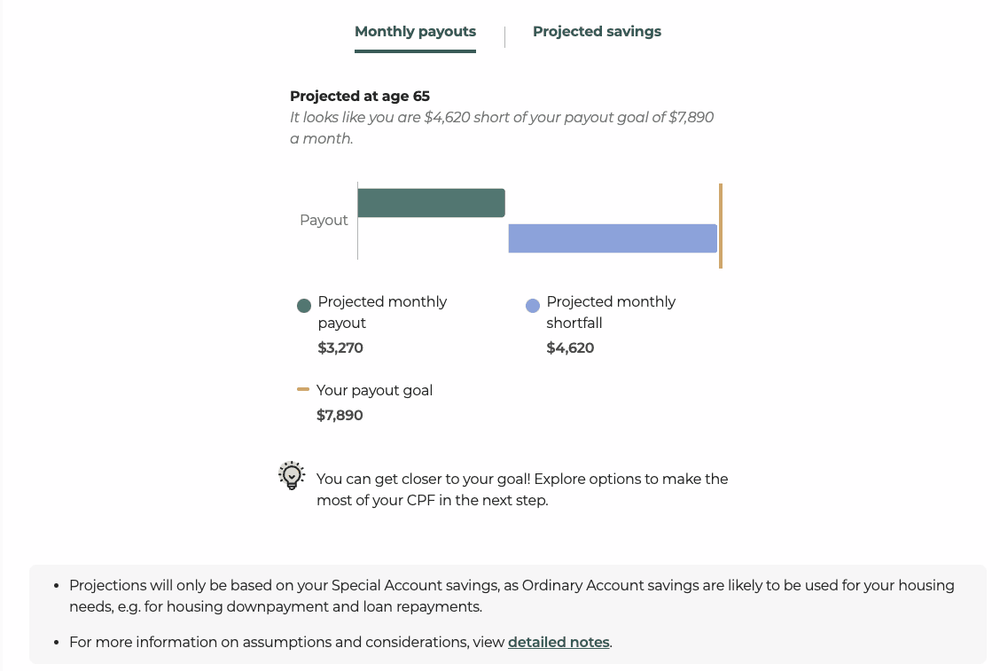

One handy tool I use is the Retirement Payout Planner.

Source: CPF website

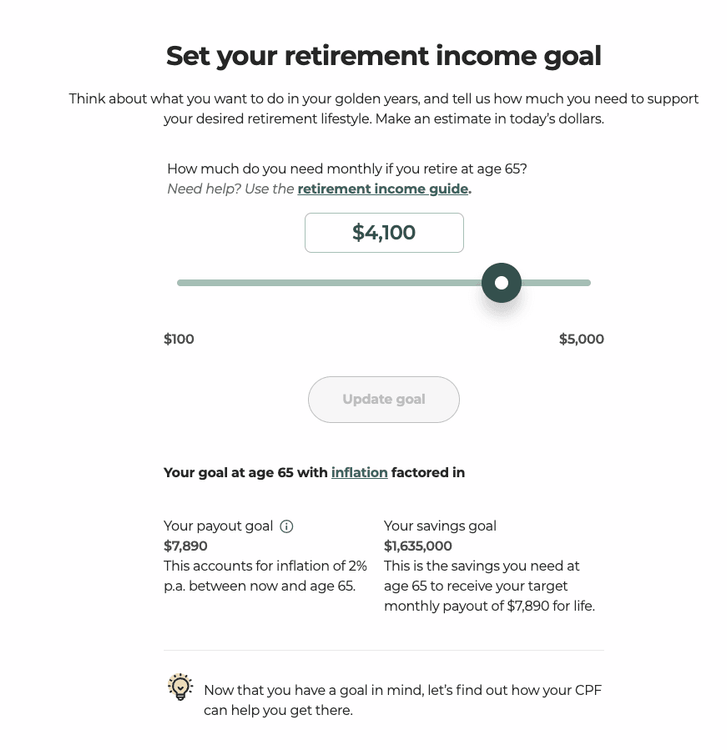

By inputting my desired lifestyle in retirement, current and projected income, and ideal CPF LIFE payouts in retirement, the CPF planner can help me project how much payouts I can expect and how much I fall short by, mapping out a starting point for me to work towards my ideal retirement lifestyle.

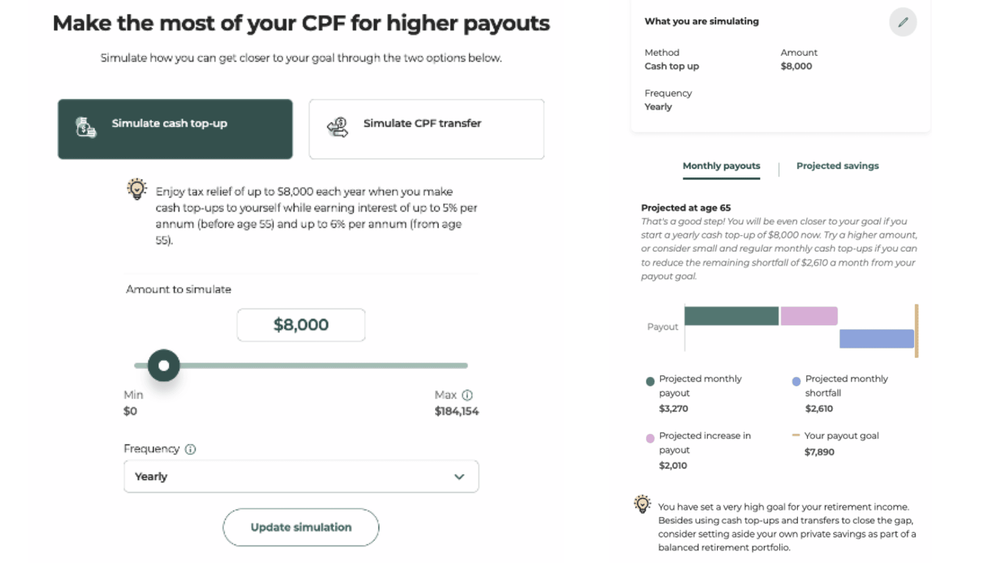

Source: CPF website

If my current projected payout amount based on my current CPF balances doesn't quite align with my retirement dreams, I can choose to make a top-up to my CPF account. Within the CPF planner, I can simulate top-ups to my CPF savings to achieve or move closer to my retirement income goal.

Source: CPF website

By strategically injecting funds into my CPF, I can leverage the power of compound interest to grow my retirement savings, and as a bonus, get tax relief of up to $8,000 each calendar year.

Side note: I get additional tax relief of up to $8,000 by topping up my parents’ CPF.

The last thing the average 30-something-year-old would probably be thinking about is writing their will and making their CPF nomination. But part of future-proofing my retirement is also ensuring that my CPF savings and other assets are distributed according to my wishes in the event of my death.

Since any earlier nominations are voided upon marriage, I will have to make a new nomination next year after we register our marriage.

#5 – Reviewing my investment portfolios

Last but not least, my year-end review has to include a review of my current investment portfolio. Just as a fund manager would conduct periodic reviews of their funds to see if they’re aligned with the fund’s investment objective, I do the same with my own portfolio.

So, I’m not just inspecting the performance of the investment but I’m aligning my investments with my life’s milestones.

With several mid-to-long-term goals that I want to achieve, having a sound investing strategy that’s reviewed regularly can help get me closer to those goals.

The first thing to look at is whether my investments are still properly diversified. As the year passes by, some of the assets in my portfolio may have changed in value.

So, rebalancing my portfolio ensures that I’m not over-concentrated in a particular asset.

Reflecting is also about taking an honest, hard look at my risk tolerance. As all investments come with risk, it's important to take stock and understand the risks involved before investing.

I’ll admit that I am not that comfortable with the amount of volatility in my current portfolio through the past year.

Learning this, I’m adopting safer, low-risk assets such as T-bills into the mix.

For retirement, the anchor of my strategy is topping up my CPF so that I can increase the payout amount I get during retirement.

Above and beyond CPF, my investment portfolio will help give me an additional stream of income to pay for my retirement lifestyle.

Wrapping up the year

Reviewing your financial health for the year can be taxing, but those hours spent will set you up for financial success in the year ahead.

As you do your own review, look into these 6 areas:

- Your emergency fund

- Your short-to-long-term goals

- Your insurance coverage

- Your housing needs

- Your retirement

- Your current investment portfolio

Be honest with yourself and realistic about your goals. Remember, the coming year is about progress, not perfection.

Learn more about how to take charge of your retirement with CPF by visiting cpf.gov.sg/BeReady.

This article was first published on Beansprout. Information in this article is accurate as of date of publication.