Extra Interest of 1%

- All CPF members earn up to 5% on the first $60,000 of their combined CPF balances

Additional Interest of 1%

- CPF members aged 55 and above earn up to 6% on the first $30,000 of their combined CPF balances.

HDB mortgage rate from 1 October 2019 to 31 December 2019

- Remains unchanged at 2.6%

Note: All interest rates are quoted on a per annum basis.

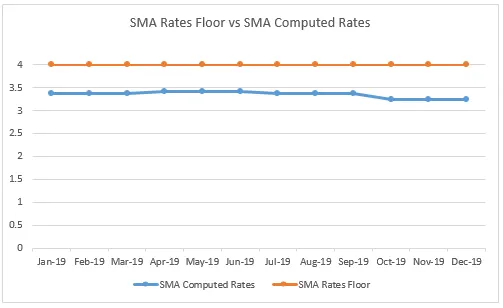

In view of the continuing low interest rate environment, the Government has further extended the 4% rate floor for interest earned on all Special, MediSave and Retirement Account (SMRA) monies for another year until 31 December 2020.

The Government had committed to providing a 4% rate floor for SMRA interest for two years since 2008, and had subsequently extended the rate floor in light of the global economic conditions and the fact that interest rates had been exceptionally low. The current 4% rate floor is due to expire on 31 December 2019.

Please refer to Annex A for more details about the SMRA rate floor.

CPF Interest Rates for Ordinary, Special and MediSave Accounts from 1 October 2019 to 31 December 2019

CPF members will continue to earn interest rates of up to 3.5% per annum on their Ordinary Account (OA) monies, and up to 5% per annum on their Special and MediSave accounts (SMA) monies in the last quarter of 2019. These interest rates include an extra 1% interest paid on the first $60,000 of a member’s combined balances (with up to $20,000 from the OA) which is part of the Government’s efforts to enhance the retirement savings of CPF members.

Members aged 55 and above will also earn an additional 1% extra interest on the first $30,000 of their combined balances. This is paid over and above the current extra 1% interest that is earned on the first $60,000 of their combined balances. As a result, members aged 55 and above will earn up to 6% interest per year on their retirement balances.

The extra interest received on the OA will go into the member’s Special Account (SA) or Retirement Account (RA) to enhance his or her retirement savings. If a member is above 55 years old and participates in the CPF LIFE scheme, the extra interest will still be earned on his or her combined balances, which includes the savings used for CPF LIFE.

Interest Rate for CPF Ordinary Account and HDB Mortgage Rate

The OA interest rate will be maintained at 2.5% per annum from 1 October 2019 to 31 December 2019, as the computed rate of 0.64% is lower than the legislated minimum interest rate of 2.5% per annum.

Correspondingly, the concessionary interest rate for HDB mortgage loans, which is pegged at 0.1% above the OA interest rate, will remain unchanged at 2.6% per annum from 1 October 2019 to 31 December 2019.

Please refer to Annex B for the detailed computation of the OA interest rate and HDB mortgage rate.

Interest Rate for Special and MediSave Accounts

The SMA interest rate will be maintained at 4% per annum from 1 October 2019 to 31 December 2019, as the computed rate of 3.24% is lower than the current interest rate floor of 4% per annum.

Please refer to Annex C for the detailed computation of the SMA interest rate.

Interest Rate for Retirement Account

The RA interest rate will be maintained at 4% per annum from 1 January 2019 to 31 December 2019, as announced on 27 September 2018.

Please refer to Annex D for the detailed computation of the RA interest rate.

Public Enquiries

CPF members can visit cpf.gov.sg or call the CPF Call Centre at 1800-227-1188 for enquiries.