Extra Interest of 1%

- All CPF members earn up to 5% on the first $60,000 of their combined CPF balances

Additional Interest of 1%

- CPF members aged 55 and above earn up to 6% on the first $30,000 of their combined CPF balances.

HDB mortgage rate from 1 January 2020 to 31 March 2020

- Remains unchanged at 2.6%

Basic Healthcare Sum (BHS) for 2020

- For members below 65 years old, BHS will be $60,000

- For members who turn 65 years old in 2020, BHS will be $60,000 and will not change for the rest of their lives

Note: All interest rates are quoted on a per annum basis.

CPF members will continue to earn interest rates of up to 3.5% per annum on their Ordinary Account (OA) monies, and up to 5% per annum on their Special and MediSave accounts (SMA) monies in the first quarter of 2020. These interest rates include an extra 1% interest paid on the first $60,000 of a member’s combined balances (with up to $20,000 from the OA) which is part of the Government’s efforts to enhance the retirement savings of CPF members.

Members aged 55 and above will also earn an additional 1% extra interest on the first $30,000 of their combined balances. This is paid over and above the current extra 1% interest that is earned on the first $60,000 of their combined balances. As a result, members aged 55 and above will earn up to 6% interest per year on their retirement balances.

The extra interest received on the OA will go into the member’s Special Account (SA) or Retirement Account (RA) to enhance his or her retirement savings. If a member is above 55 years old and participates in the CPF LIFE scheme, the extra interest will still be earned on his or her combined balances, which includes the savings used for CPF LIFE.

Interest Rate for CPF Ordinary Account and HDB Mortgage Rate

The OA interest rate will be maintained at 2.5% per annum from 1 January 2020 to 31 March 2020, as the computed rate of 0.64% is lower than the legislated minimum interest rate of 2.5% per annum.

Correspondingly, the concessionary interest rate for HDB mortgage loans, which is pegged at 0.1% above the OA interest rate, will remain unchanged at 2.6% per annum from 1 January 2020 to 31 March 2020.

Please refer to Annex A for the detailed computation of the OA interest rate and HDB mortgage rate.

Interest Rate for Special and MediSave Accounts

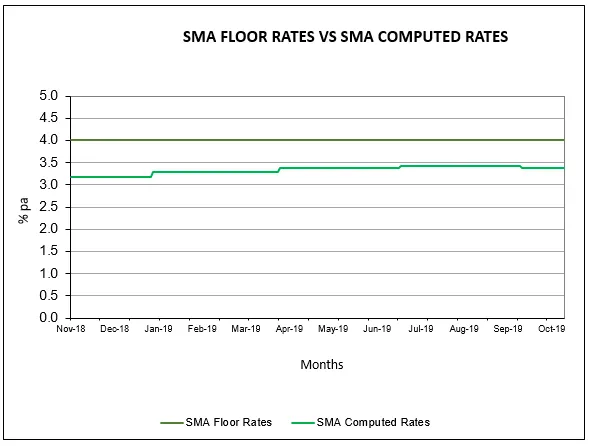

The SMA interest rate will be maintained at 4% per annum from 1 January 2020 to 31 March 2020, as the computed rate of 3.05% is lower than the current interest rate floor of 4% per annum.

Please refer to Annex B for the detailed computation of the SMA interest rate.

Interest Rate for Retirement Account

The RA interest rate will be maintained at 4% per annum from 1 January 2020 to 31 December 2020, as announced on 20 September 2019.

Please refer to Annex C for the detailed computation of the RA interest rate.

Basic Healthcare Sum for 2020

The Basic Healthcare Sum (BHS) is the estimated savings required for basic subsidised healthcare needs in old age. The BHS is adjusted yearly for members below age 65 to keep pace with the growth in MediSave withdrawals. Once members reach age 65, their BHS will be fixed for the rest of their lives.

From 1 January 2020,

- For members below 65 years old, their BHS will be raised from $57,200 to $60,000.

- For members who turn 65 years old in 2020, their BHS will be fixed at $60,000, which will not change thereafter.

For members aged 66 and above in 2020, their cohort BHS had already been fixed and will remain unchanged.

Please refer to Annex D for the BHS for respective cohorts.

BHS is the cap to the MediSave Account (MA) and contributions in excess of a member’s BHS will be automatically transferred to his or her other CPF accounts. A higher BHS will allow for more savings to be kept in a member’s MA for his or her healthcare needs. CPF members do not have to top up their MA if they have less than the BHS.

Public Enquiries

CPF members can visit cpf.gov.sg or call the CPF Call Centre at 1800-227-1188 for enquiries.