14 Nov 2025

SOURCE: MoneySmart

I’m approaching my 30s, and like many Singaporeans, I’ve started daydreaming about buying a home with my partner. To us, a home isn’t just 4 walls — it’s where our life together truly begins. We’ve always told each other that we’re already each other’s “home” (cheesy, I know), but the thought of finally creating a physical one, with space for our future fur kids, feels like the next big step.

Then one day, my finance-savvy dad asked, “If you’re putting so much into the downpayment, what about your retirement savings?” That stopped me in my tracks. I’d always thought buying a flat was simple: find one we liked, get the loan, done. But I realised home ownership and retirement are linked—since the CPF used for housing also affects my retirement savings.

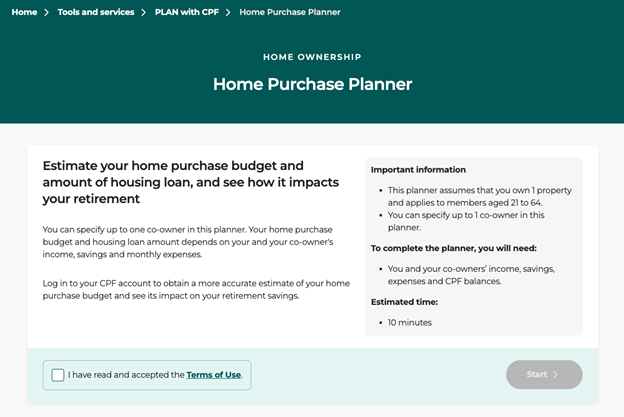

After that chat with my dad, I realised I’d been so focused on the present that I hadn’t thought about the bigger picture—my future. While reading up on how CPF affects both housing and retirement, I discovered the CPF Board’s Home Purchase Planner.

Turns out, “Can I afford this flat?” wasn’t the only question I should’ve been asking.

I’ve been working for about 5 years now, and my partner and I are in the very early stages of exploring our first home together.

We want to be near our parents, have easy access to food and markets, and live somewhere peaceful but not too far from the city.

We haven’t applied for a loan or any flat yet—we’re still doing our homework. That meant poring over property listings, checking past Build-To-Order launches, and trying to estimate how much of our savings we could safely set aside for the downpayment. We even played around with online loan calculators to get a rough sense of monthly repayments.

But when I tried CPF’s Home Purchase Planner, I realised our “homework” only scratched the surface. While our spreadsheets and calculators provided an estimate of the monthly loan repayments, the planner connected the dots to the bigger picture, showing how our dream home shouldn’t come at the expense of our retirement goals.

Source: Home Purchase Planner

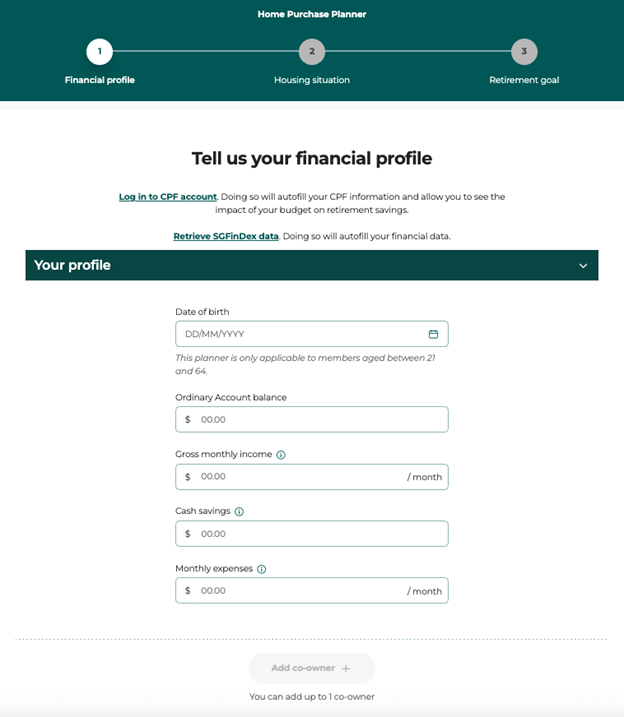

I’ll admit: I usually hate filling in forms. But once I clicked the option to log in via Singpass, the planner automatically pulled in my CPF information, including my Ordinary Account (OA) balance. That was a huge relief. From there, I only had to enter a few details: my gross monthly income, cash savings, and monthly expenses. The planner also offered an option to add my partner as a co-owner; I filled in the necessary information, and we were good to go.

Source: Home Purchase Planner

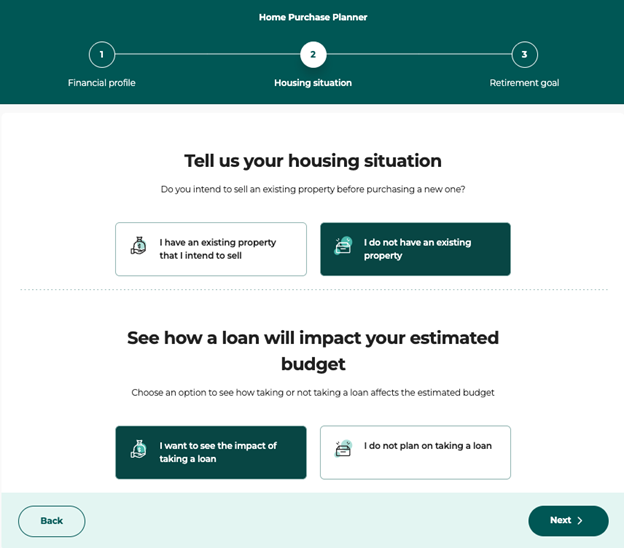

Next, we were asked about our current housing situation. Since we don’t own any property, I selected “I do not have an existing property”.

After that, the planner then asked if we wanted to see how taking a loan would impact our budget. We realistically would need one, so I selected ”I want to see the impact of taking a loan”.

Source: Home Purchase Planner

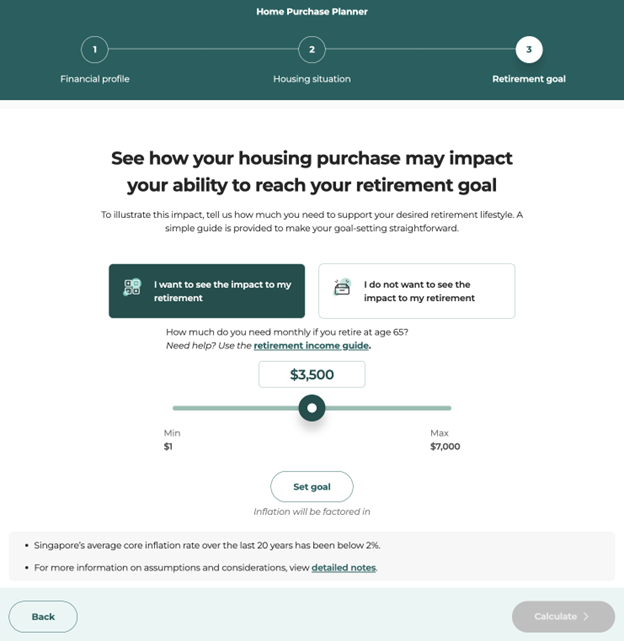

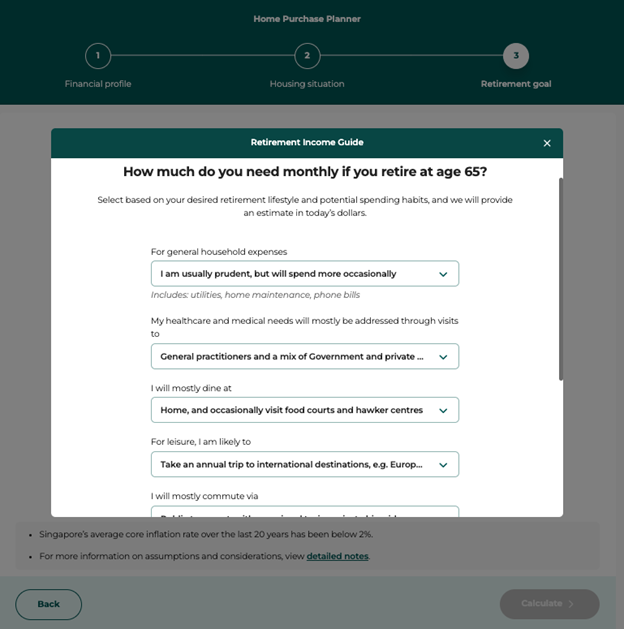

This was the most eye-opening part. The planner asked if I wanted to see how a home purchase might affect my retirement goal. Of course, I said yes. After all, this was what I'd been trying to figure out.

It then asked how much I thought I would need each month when I retire at 65. Honestly, I wasn’t sure. But the planner offered a helpful retirement income guide—asking questions about my healthcare needs and typical lifestyle, like where I’d mostly dine.

Based on my answers, it estimated I’d need about $3,180 per month. I decided to round it up and set my retirement goal at $3,500.

Source: Home Purchase Planner

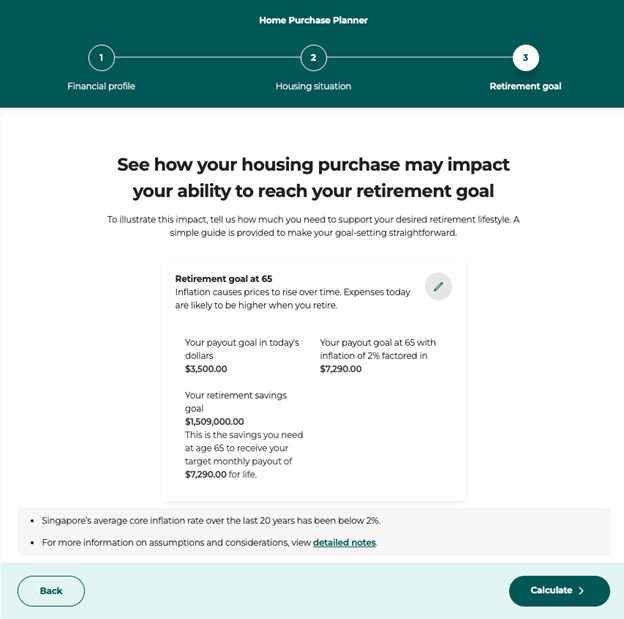

After I clicked “Set goal”, the planner then factored in inflation, which made everything much more realistic. It showed that I would actually need $7,290 a month at age 65 to maintain the same lifestyle.

Source: Home Purchase Planner

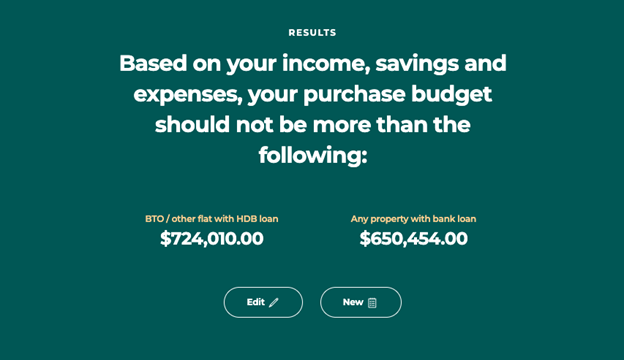

All that was left was to hit the “Calculate” button. On the final page, the planner broke everything down in detail.

It showed us the HDB vs bank loan options based on our combined income, savings, and expenses. The planner recommended a maximum purchase budget of $724,010 for an HDB flat with an HDB loan, or $650,454 if we were to take a bank loan. Our monthly instalments would be about $2,464, which we deemed manageable.

Source: Home Purchase Planner

For comparison, I had roughly estimated a BTO flat would cost about $650,000:

- 25% downpayment = $162,500

- Remaining 75% = $487,500

- Monthly repayments (over 25 years, ~2.6% interest) ≈ $2,211

- Split evenly with my partner ≈ $1,105 each

So far, so good.

It also reminded us about upfront costs such as stamp duty and legal fees. For us, stamp duty alone could mean an extra $27,181! However, CPF can’t be used for everything. Renovation costs, service and conservancy charges, property taxes, and other ongoing fees must be paid in cash.

Aside from home financing, the planner also showed me the direct impact on my retirement: instead of receiving my target monthly payout of $7,290 at age 65 (adjusted for inflation), I’d only be receiving about $5,300 — a shortfall of $1,990 every month.

Source: Home Purchase Planner

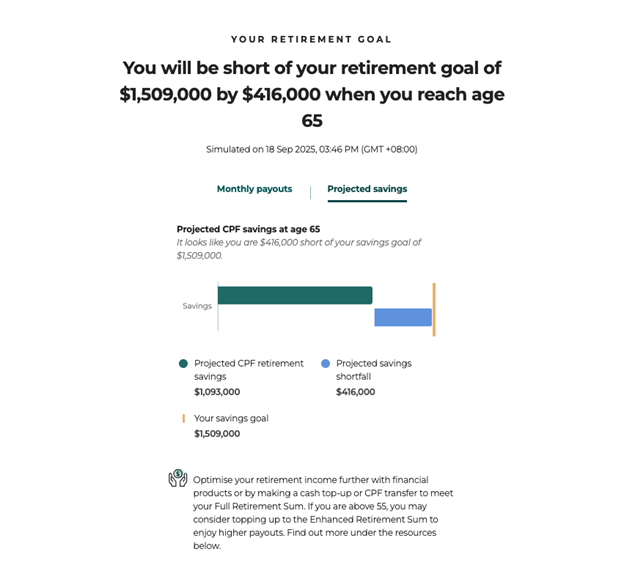

It also projected my retirement savings. Compared with my goal of $1,509,000, I’d be about $416,000 short.

Source: Home Purchase Planner

The planner made it clear: using too much of my OA for housing leaves little buffer now and less left for retirement later. Here’s why: at age 55, my OA and Special Account (SA) balances will be transferred to my Retirement Account (RA) up to the Full Retirement Sum. Less in my OA today means less flowing into my RA — and smaller CPF LIFE payouts at 65.

If I had drained my OA savings as planned, my balance would be nearly zero. Over-relying on my OA savings for housing would leave little buffer — meaning I’d be in trouble if I ever stopped working and only relied on my OA savings for the monthly loan instalments.

Seeing the numbers laid out so clearly was both sobering and empowering. I instantly thought back to my dad’s question: “If you’re putting so much into the downpayment, what about your retirement savings?” The planner gave me the answer in black and white.

At first, the revised projected payout of $5,300 a month still sounded comfortable. But when I broke it down—bills, groceries, insurance, healthcare, and the occasional trip—the margin for flexibility was much smaller than I’d thought. It could mean putting off travel, cutting back on dining out, or delaying upgrades I’d hoped to enjoy later.

It was confronting, but I was glad to realise it now rather than years later. The planner didn’t just crunch numbers—it helped me see the trade-offs in real terms and gave me clarity on what “affordability” really means.

Beyond setting aside $20,000 in my OA as a buffer and paying part of my mortgage in cash, I’m also focusing on growing my CPF savings. All CPF balances earn compound interest—with an extra 1% on the first $20,000 in the OA—but topping up my SA helps my money grow even faster, since it earns a higher interest rate of up to 5% p.a. and is ring-fenced for retirement.

This way, I’m strengthening my long-term savings while managing my housing costs, and I also enjoy up to $8,000 tax relief on cash top-ups made to my CPF.

Additionally, I learnt about the Mortgage Servicing Ratio (MSR)—a limit on how much of your gross monthly income can go towards property loans. It helps ensure your housing costs stay manageable and don’t eat into other financial goals. The planner recommended keeping my MSR under 25%, so my monthly mortgage payments stay comfortable while still leaving room for other needs and wants like insurance, savings, and yes, our future fur kids.

Most importantly, my partner and I reviewed the Home Purchase Planner results together. Seeing the numbers clearly showed us the real impact on our future together and helped us decide with confidence. While our dream BTO is technically within reach, we decided to start with a more affordable flat. This keeps our budget manageable today, allows us to preserve some cash and CPF savings for retirement, and gives us peace of mind for the years ahead.

The Home Purchase Planner helped me see how my housing choices today affect my finances tomorrow. It balanced lifestyle goals with long-term security, showing the real trade-offs between spending now and saving for later.

Whether you’re buying your first or next home, the planner’s simple step-by-step guide and visual tracker make it easy to use. It takes just 10 minutes — but could change how you plan your home and your future.

Try out CPF Board’s Home Purchase Planner today, and explore more helpful tools and resources here to help you achieve financial clarity.

This post was created in partnership with CPF Board. All views and opinions expressed in this article are MoneySmart's objective and professional opinions.

This article was first published on MoneySmart. Information in this article is accurate as of date of publication.

.jpg)

.jpg)