23 Apr 2021

Source: MyNiceHome

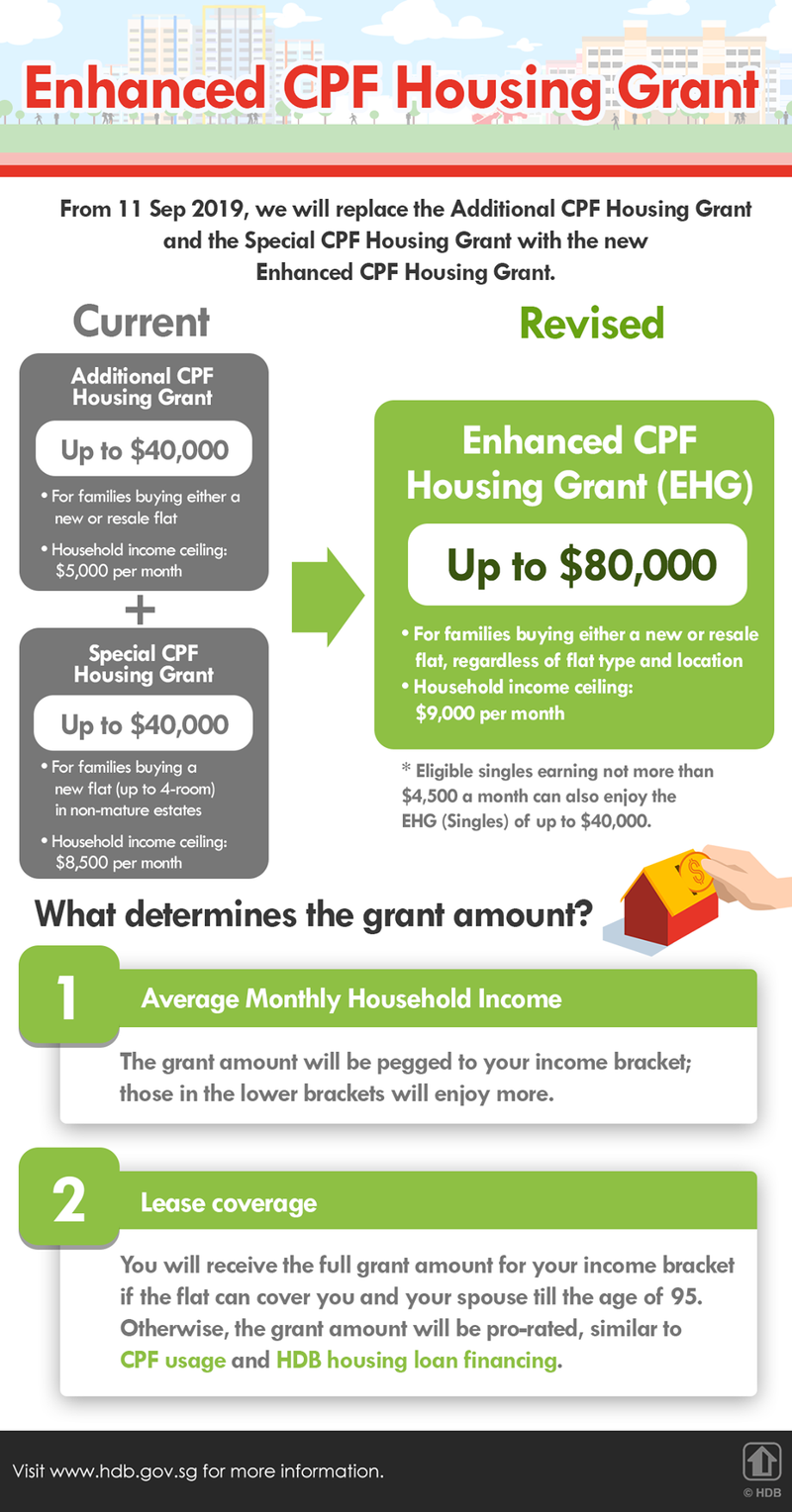

To make housing more affordable and accessible to Singaporeans, MND and HDB recently announced the Enhanced CPF Housing Grant (EHG), which replaces the Additional CPF Housing Grant (AHG) and Special CPF Housing Grant (SHG). Under the EHG, eligible first-time flat buyers enjoy up to $80,000 in housing grants.

What is EHG?

The EHG is a new housing grant for first-time flat buyers. It is applicable for new flat applications from the September 2019 sales exercise and resale flat applications submitted from 11 September 2019. Applications submitted before the date will not qualify for EHG.

How much EHG am I eligible for?

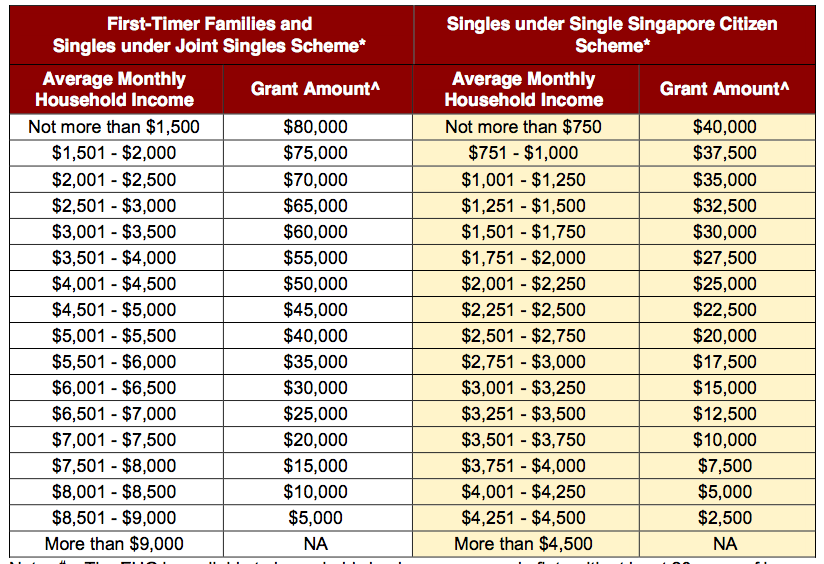

Eligible first-timer applicants for new flats can now enjoy an EHG of up to $80,000, while eligible first-timer singles can enjoy an EHG (Singles) of up to $40,000.

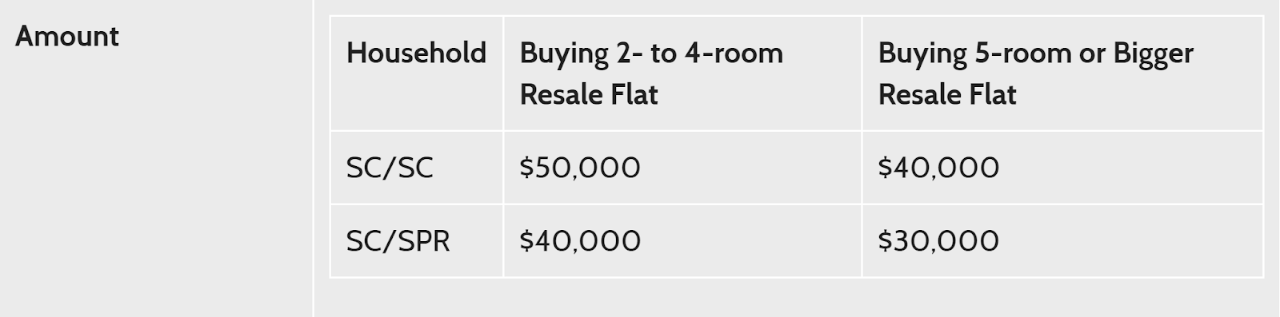

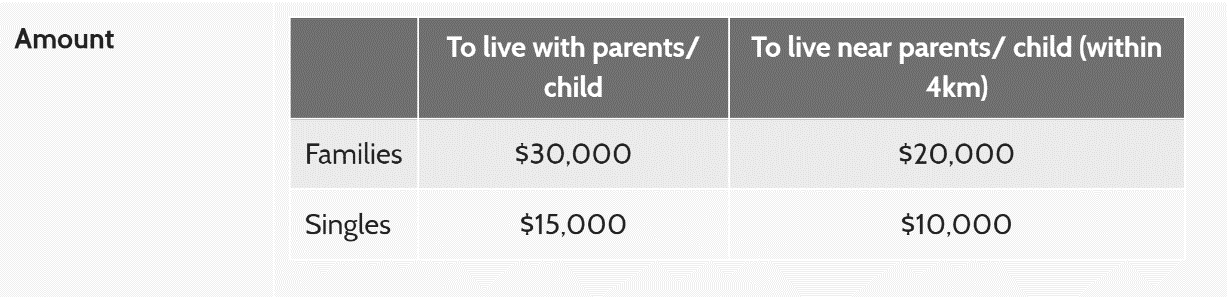

Similarly, eligible first-time applicants for resale flats can also enjoy an EHG of up to $80,000, in addition to the CPF Housing Grant (up to $50,000) and Proximity Housing Grant (up to $30,000). This means that first-time resale homebuyers can enjoy up to $160,000 in housing grants!

How does EHG work?

To qualify for EHG, the monthly household income for first-timer families should not exceed $9,000 (refer to Table 1 below). The buyer or his/her spouse must also be in continuous employment for the 12 months prior and remain working at the point of flat application.

Eligible first-timer singles must be aged 35 and above, with a monthly income of up to $4,500. The buyer must be in continuous employment for the 12 months before the flat application and remain working at the point of flat application.

Table 1: EHG Structure

*The EHG is applicable for those buying 2-room Flexi flats on 99-year leases in the non-mature estates, 2-room Flexi flats on short leases and resale flats (up to 5-room under the Single Singapore Citizen Scheme, and all resale flats under the Joint Single Scheme).

^The EHG amount is applicable to households buying a flat with a remaining lease that can cover the buyers and their spouses to the age of 95; otherwise, the household will enjoy a pro-rated EHG.

New Flat Applicants

Unlike the previous SHG, the EHG is applicable for all flats, regardless of flat type and location.

For example, Couple A has an average monthly household income of $4,800 and is looking to buy a 4-room BTO flat in Tampines, a mature estate. With the introduction of EHG, Couple A can enjoy an additional $40,000 in housing grants.

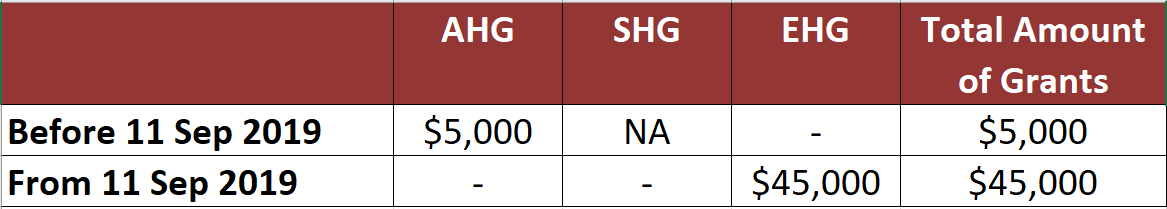

Example 1

Resale Flat Buyers

Previously, resale flat buyers could only enjoy an AHG of up to $40,000 but not the SHG. Under the EHG, they can now enjoy an EHG of up to $80,000. This would mean that eligible first-time buyers of resale flats can enjoy up to $160,000 in housing grants, which includes the EHG (up to $80,000), CPF Housing Grant (up to $50,000) and PHG (up to $30,000).

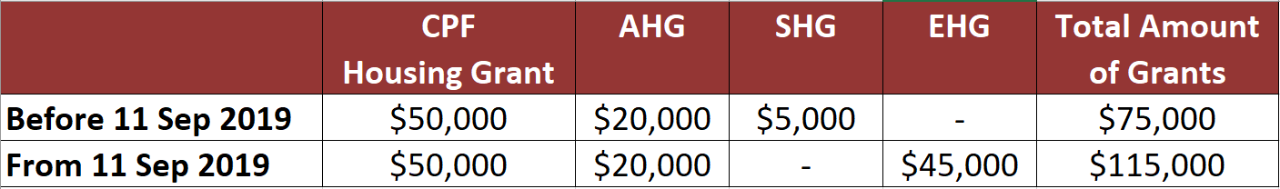

Table 2: CPF Housing Grant

Table 3: Proximity Housing Grant

For example, Couple B has an average monthly household income of $4,800. The couple is buying a 4-room flat in a mature estate to live near their parents. With the introduction of EHG, Couple B can now enjoy an additional $40,000 in housing grants:

Example 2

What happens if the remaining lease of the flat I buy does not cover the youngest owner and spouse till the age of 95?

To enjoy the full EHG amount for the relevant income brackets, the purchased flat must have sufficient lease to cover the buyers and their spouses to the age of 95. Otherwise, the amount of grant will be pro-rated. This condition also applies to repurchased flats under the Sales of Balance Flats or Re-Offer of Flats exercises.

For example, Couple C, both aged 30, with an average monthly household income of $4,800, has purchased a resale flat with a remaining lease of 60 years. As the flat cannot cover them to the age of 95, they can enjoy an EHG of $40,000 as opposed to the full EHG amount of $45,000 for their income bracket.

In a Nutshell

Under the EHG, eligible first-timer applicants for new flats can now enjoy up to $80,000 in housing grants while eligible first-timer singles can enjoy up to $40,000 in housing grants.

Eligible first-time buyers of resale flats can enjoy up to $160,000 in housing grants, which includes the EHG (up to $80,000), CPF Housing Grant (up to $50,000) and PHG (up to $30,000).

Whether it’s applying for the upcoming November BTO sales launch or purchasing a resale flat, remember to factor in the EHG when planning for your new home!