26 Sep 2025

SOURCE: CPF Board

You’re a proud homeowner, so what’s next? Managing your housing loan and staying on top of your repayments is crucial for long-term financial stability. Before moving forward, ask yourself these three key questions to help you make smart, informed decisions about your housing loan.

An HDB housing loan currently offer a fixed interest rate of 2.6%* (pegged at 0.1% above the CPF Ordinary Account interest rate) and greater flexibility with no lock-in or early repayment penalties.

Bank loans may provide lower initial rates, but these can fluctuate (pegged to benchmarks like the Singapore Overnight Rate Average) and often include lock-in periods and early repayment penalties.

*As of September 2025

Note: If your HDB flat is currently financed with a bank loan, you will not be able to switch to an HDB housing loan for that property.

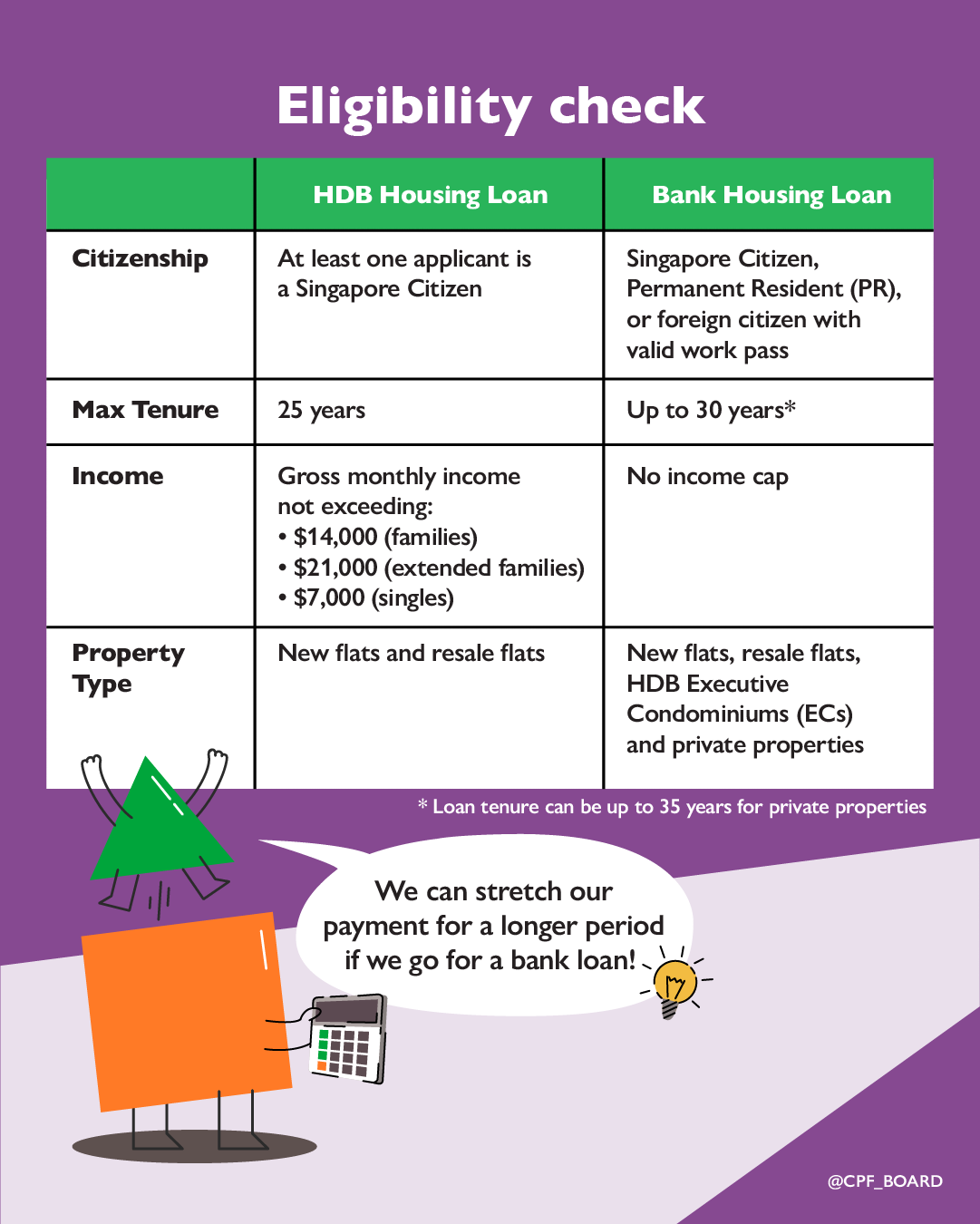

Key differences:

|

HDB housing loan

|

Bank housing loan

|

Interest rates

|

Currently at 2.6% per annum

|

Fluctuates with market conditions

|

Lock-in period

|

No

|

Yes

|

Lump sum repayment/ full redemption of loan

|

No additional charges

|

Additional charges may apply

|

Housing prudence means figuring out how much you can actually afford, instead of just going for the maximum loan possible. Use the Total Debt Servicing Ratio (TDSR) and Mortgage Servicing Ratio (MSR) to assess affordability:

TDSR: All monthly debt repayments (including your new home loan) must not exceed 55% of your gross monthly income (combined if applying with a partner)

MSR: For HDB flats or executive condominiums (minimum occupation period has not expired) only. Your home loan instalments are capped at 30% of your gross monthly income.

When you plan your budget, be sure to factor interest rate changes, job stability, and future expenses (renovations, family needs) to ensure that your home is truly affordable. Stretching your budget too far increases risks if interest rate rises or income changes.

Choose a loan tenure and monthly repayment that fits comfortably in your long-term budget.

Your Ordinary Account (OA) savings provide support for your monthly housing loan repayments, reducing out-of-pocket expenses. However, using cash to pay for your home preserves your CPF savings for retirement and allows your OA savings to earn risk-free interest.

For your current repayment plan, consider paying more of your instalments using cash instead for future flexibility. Your OA savings can also act as a safety net for your housing payments in unforeseen circumstances. Review your long-term financial plan regularly so you don’t compromise your future retirement payouts.

You can use the home ownership dashboard to track and manage your OA usage and adjust your monthly CPF deductions.

By understanding these considerations, you can make smarter decisions that keep your home loan affordable and give you greater financial security, both today and in retirement.

Information in this article is accurate as at the date of publication.

.jpg)