1) What are CPF monies invested in?

CPF savings are invested by the CPF Board in Special Singapore Government Securities (SSGS), which are issued and guaranteed by the Singapore Government.

The proceeds from SSGS are pooled together with other sources of Government funds, such as Government surpluses and land sales receipts. GIC, as the Government's fund manager, receives funds from the Government and manages them on a consolidated basis, taking calculated risks aimed at achieving good, long-term returns..

The returns from these SSGS match the interest rates on CPF savings. This means that CPF members will receive the interest rates as announced on their CPF savings, regardless of whether the investment market is performing poorly. This is guaranteed as the Singapore Government is one of the highest credit-rated (triple-A) governments in the world.

2) How are CPF interest rates determined?

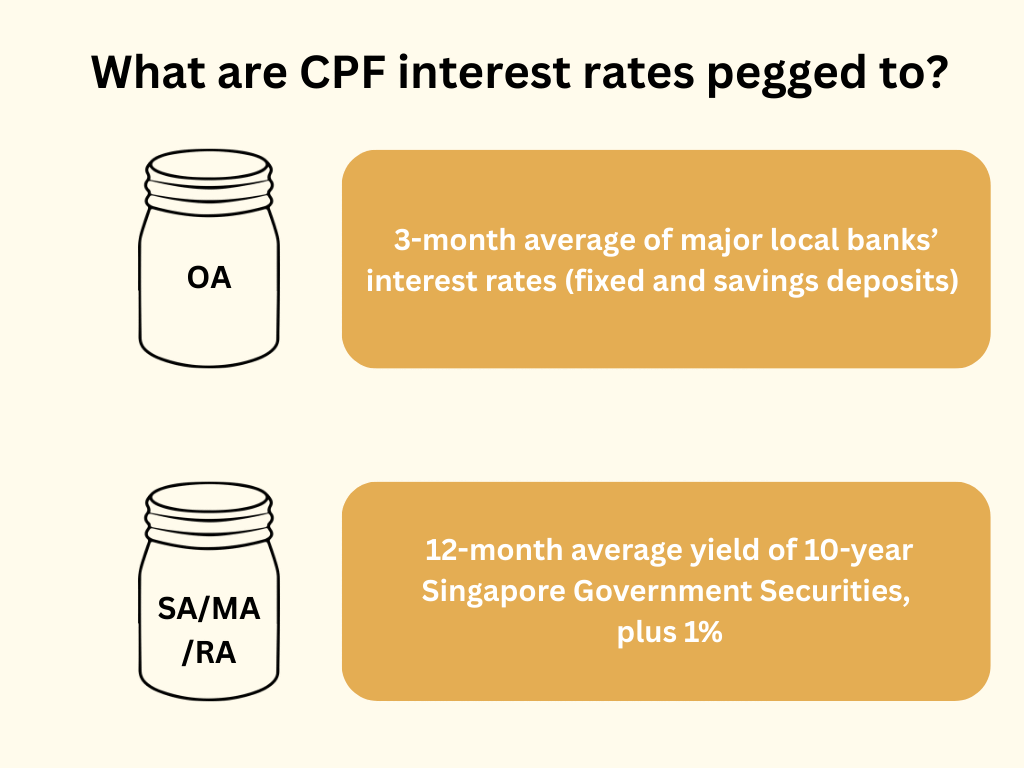

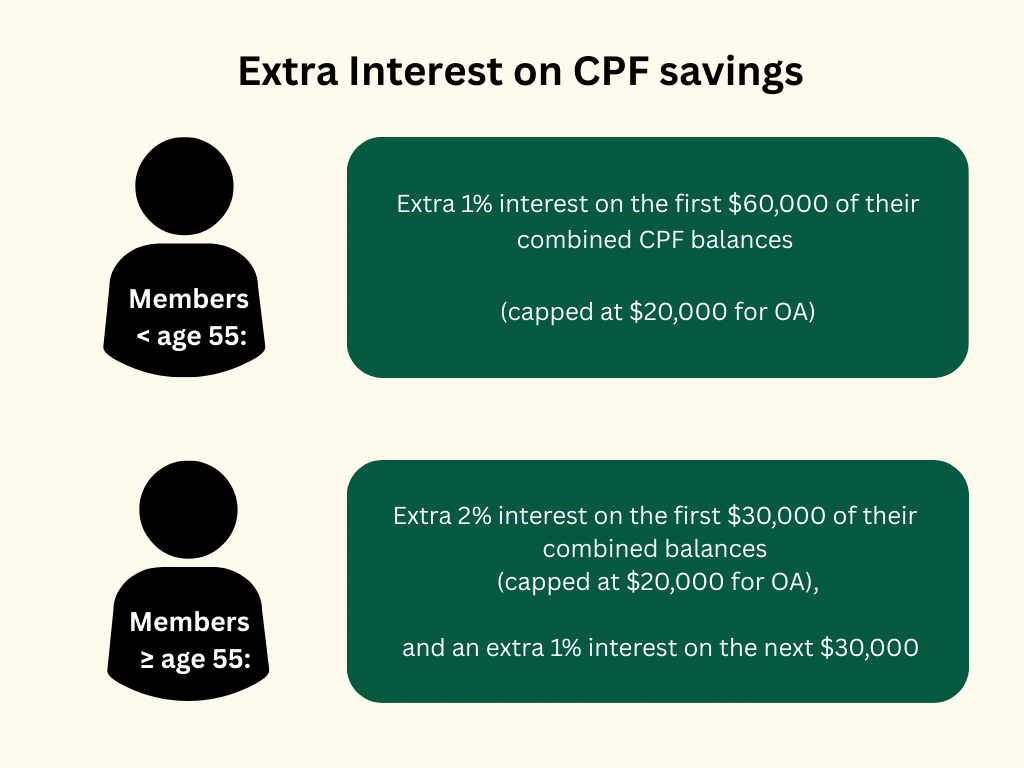

The interest rates earned by CPF savings are risk-free and pegged to the returns on market instruments of comparable risk and duration. In addition, the Government provides floor rates on CPF interest (2.5% per annum for OA and 4% per annum for SA/MA/RA), as well as extra interest of up to 2% per annum. As a result, currently CPF members aged 55 and above can earn a risk-free rate of up to 6% per annum on their CPF savings, while those below 55 can earn up to 5% per annum.

When the pegged rates exceed the floor rates, CPF savings will correspondingly earn higher interest rates. When market interest rates are low, the Government continues to pay the floor rates. This arrangement protects CPF members against investment risk, particularly the risk of negative returns, and ensures CPF savings are safe even when the market performs poorly.

To help boost retirement savings, the Government pays Extra Interest on the CPF Balances of members. The extra interest is structured so that all CPF members benefit, and members with lower balances benefit more.

3) Why are CPF interest rates not pegged to GIC’s investment returns?

Pegging CPF interest rates to GIC’s returns would subject CPF members to investment market risks. This means that the interest that would be paid on members’ CPF savings would fluctuate depending on market conditions and as a result be more uncertain. In a very bad investment market, it might even be negative.

Instead of pegging CPF interest to GIC’s returns, the Government protects CPF members from bearing any investment risk, and provides them with certainty over the interest rate paid on their CPF savings regardless of market conditions.

In years when investment returns are poor, the Government’s buffer of net assets helps to absorb any losses and ensures that the Government can meet its obligations on the SSGS. These net assets are in turn built up in years of good investment returns.

4) What does the Government use the monies from SSGS for?

The Government manages the monies from SSGS on a commingled basis and invests through GIC to ensure that it is able to consistently meet its long-term obligations, including SSGS interest payments and redemptions.

GIC therefore manages the monies with the aim of earning good returns on a long-term basis.

5) How can CPF members get higher returns on their CPF monies?

CPF members can consider transferring their Ordinary Account savings to their Special or Retirement Account for higher returns of up to 5% and 6% per annum1 respectively, to eventually enjoy higher retirement payouts.

For CPF members who are prepared to take on more risk to grow their CPF savings on their own for potentially higher returns, the CPF Investment Scheme (CPFIS) offers members the option to invest part of their CPF savings in a range of financial products, such as shares, unit trusts, government bonds, and treasury bills, allowing members to tailor their investment strategy to their risk appetite.

The CPF Board has also been making enhancements to the CPFIS over the past two decades. This includes raising the quality of funds offered, reducing the cost of investing and most recently, bringing in more low-cost funds.

It is important to note that all investments are subject to risks, including potential loss of capital due to market fluctuations. Understanding these risks would help members select investments that are aligned with their investment goals, risk tolerance, and personal circumstances.

1 Based on the Q2 2025 4% interest rate floor on Special and Retirement Account monies.

6) Do CPF members continue to earn interest when they join CPF LIFE?

The interest earned by CPF members on their CPF savings will be credited to their CPF accounts.

When members join CPF LIFE, their premium will be deducted from their Retirement Account. The interest earned on these premiums will continue to accrue and is factored into their monthly payouts, enabling them to receive higher payouts right from the start.

With risk-pooling, the interest on the remaining premium upon a member’s passing is pooled and go towards the monthly payouts of surviving CPF LIFE members. This is key to ensuring that CPF LIFE remains sustainable, enabling members to continue receiving lifelong payouts, even after their own premium and interest have been used up. No one is able to accurately predict how long they will live, so every member has a chance of outliving their savings and tapping on the pooled interest to sustain their payouts.

CPF Board does not retain any of the interest earned by CPF members on their CPF savings.

This article was first published on 20 May 2025 at Factually