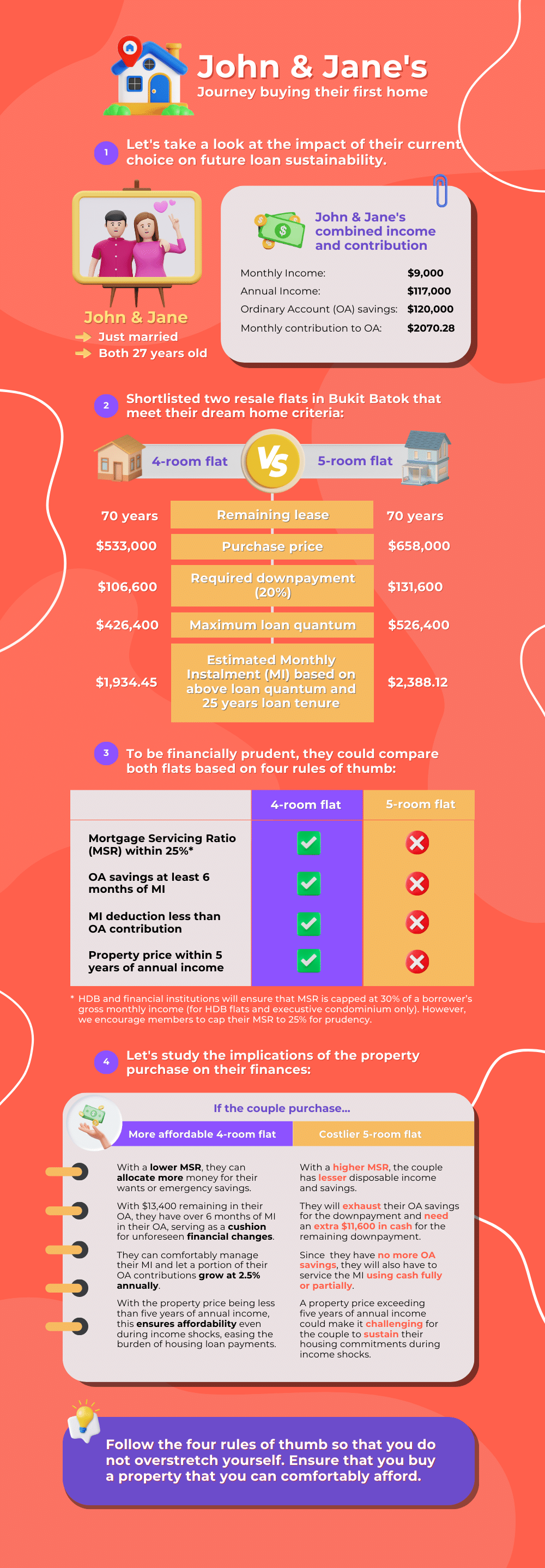

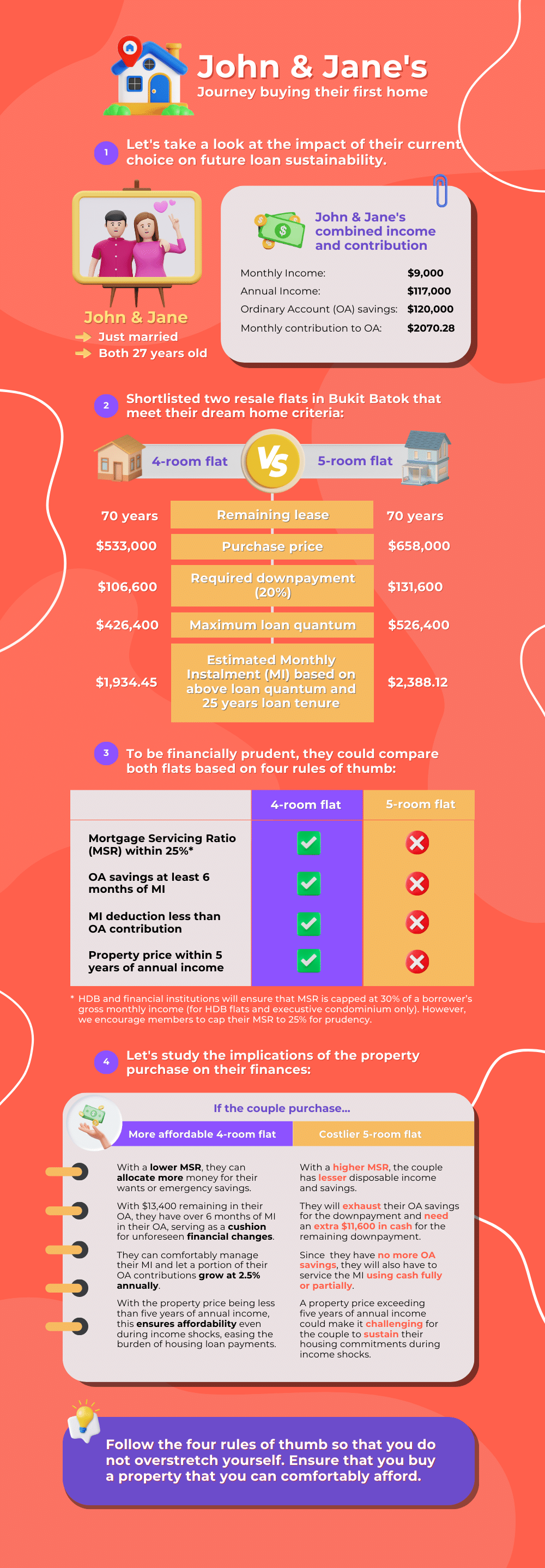

If you are buying a property, here are the four rules-of-thumb to keep in mind.

Read on to learn how these rules can impact your finances. The following is a case study that compares the buying decisions of John and Jane and how a property purchase can affect their financial health.

Additionally, here are some other things that you should also look out for.

Your eligibility to buy a property

For HDB flat, check your eligibility criteria at HDB website.

For private property, check your eligibility criteria at URA website.

Your CPF Ordinary Account (OA) balance

It is important to find out how much Ordinary Account (OA) savings you have to finance your purchase. Your existing OA balance and your future monthly CPF contributions to your OA will help you decide an affordable home price. You can use our First home calculator to estimate a housing loan and property price based on your income and your ability to service the loan.

You can check your CPF OA balance on Member dashboard by logging in at our CPF website using your Singpass. Otherwise, you may visit any of the CPF Service Centre.

Your finances

Work out the amount of cash savings you have and the amount of housing loan you can get.

Encumbrances on the property that you are buying

For HDB flat, check with HDB or the seller if you are buying a resale flat from the open market that they will be refunding their CPF principal amount withdrawn and accrued interest used towards the flat so that the CPF charge can be lifted.

For private property, check with your lawyer to make sure your property is free of any charges (i.e., CPF charge, mortgage charge) upon completion.

Apply to use your OA savings

Apply through HDB if you are taking an HDB loan or your lawyer if you are taking a bank loan.