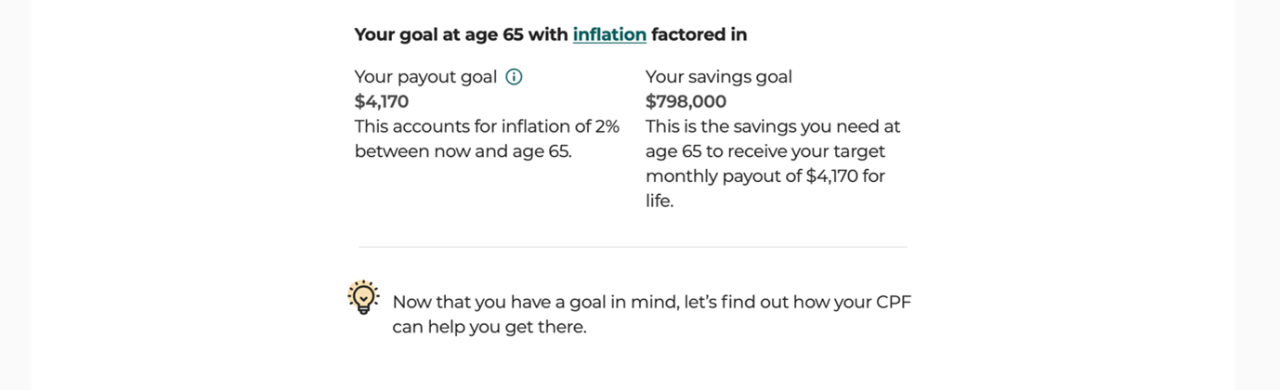

In order to live a retirement on our own terms, we need to have sufficient savings. This will depend on how far away we are from our desired retirement age as well as the retirement lifestyle we wish to lead.

One way to grow our retirement pot is to invest our savings. Especially for those who have a longer runway to retirement and/or limited knowledge, we can build a retirement pot that delivers the market return. This way, we can ride out the ups and downs of the market, to earn the market return in the long run. Historically, investing in globally diversified stocks can give us a return of 6.5% to 7%.

Alternatively, we can also invest in bonds, or fixed income. Generally speaking, bonds tend to be safer than stocks. Another benefit is that they also typically pay a regular interest distribution on a semi-annual basis – giving us more visible cash flows.

However, as we may have seen in 2022, the financial markets can be extremely volatile. Stocks have fallen steeply, while bonds haven’t been spared either as interest rates have risen in tandem with inflation.

Even if we don’t have the stomach for volatility when investing our retirement savings, we can still rely on safer forms of retirement income.

Another common way to fund our retirement is our homes. Once the children leave to start their own families, we can either choose to rent out spare bedrooms, or even monetise our homes via the Lease Buyback Scheme (by selling part of our HDB flat’s lease while continuing to live in it) or Silver Housing Bonus scheme (by moving to a 3-room or smaller flat) and enjoy a cash bonus of up to $30,000. Part of the net sales proceeds will go into our Retirement Account (RA) to boost our retirement nest egg.

Read Also: Lease Buyback Scheme, Right-sizing Or Rent Out A Room? Which Is The Ideal Option For Retirees Looking To Increase Passive Income

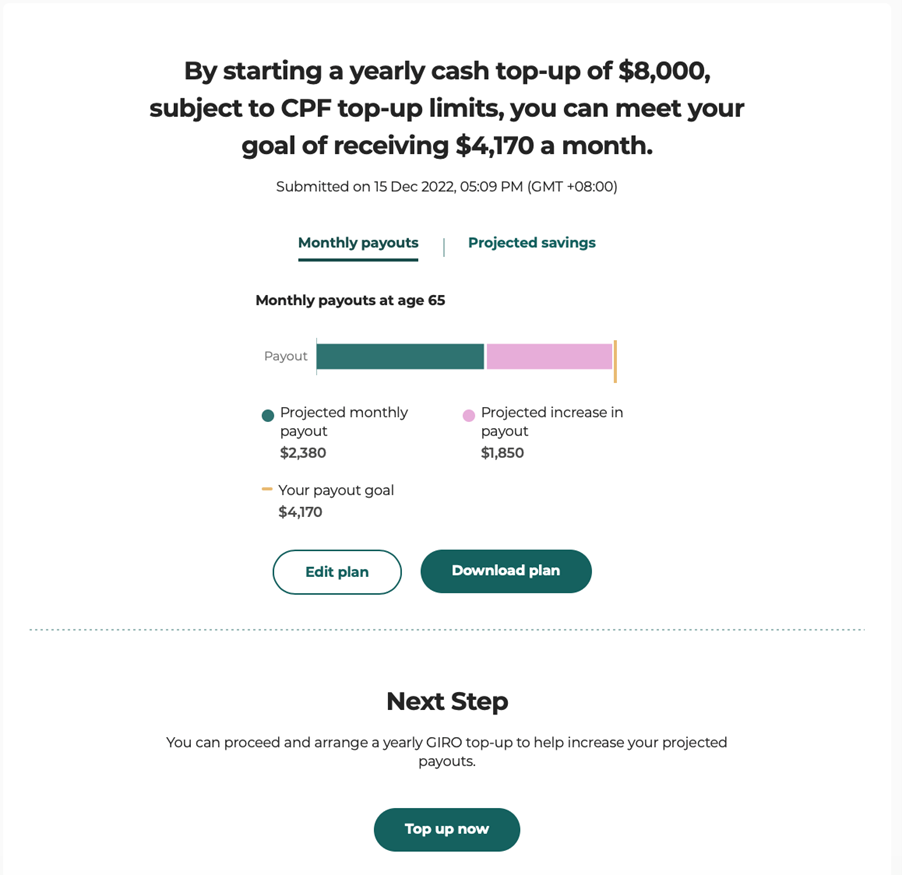

Today, we can top up our CPF Special Account with cash, via the Retirement Sum Topping Up (RSTU) Scheme. The main benefit is that our principal is guaranteed, and we get to earn a risk-free floor interest rate of 4% per annum (p.a.). Furthermore, topping up allows one to enjoy up to $8,000 of tax relief and a further tax relief of up to $8,000 if cash top-ups were made to our loved ones*.

The maximum that we can top up to is up to the Full Retirement Sum (FRS) for that year: $192,000 in 2022 and $198,800 in 2023. However, many of us may not opt to do so e.g. preference of having cash on hand. Some of us may also prefer to invest a smaller amount and divert the rest of it into our Special Account in extremely volatile periods.