20 Feb 2026

SOURCE: CPF Board

There are many options available to help grow your CPF savings, and choosing the right one for you means finding the one that best aligns with your needs and preferences. Examples include making cash top-ups to your or your loved ones’ CPF accounts, or even via the CPF Investment Scheme (CPFIS), should you be willing to take more risks.

Because your CPF savings can be used in a variety of areas, from housing to healthcare to retirement, it’s important to understand how your CPF savings grow, including how CPF interest rates are computed.

Your CPF savings grow via what is known as compound interest. The interest on your existing CPF savings will earn additional interest. This means that your CPF savings grow faster and at a steady pace, even without constant monitoring from you.

Knowing that your savings can grow on their own at a steady rate is helpful, but how did these interest rates come about? Let’s take a look.

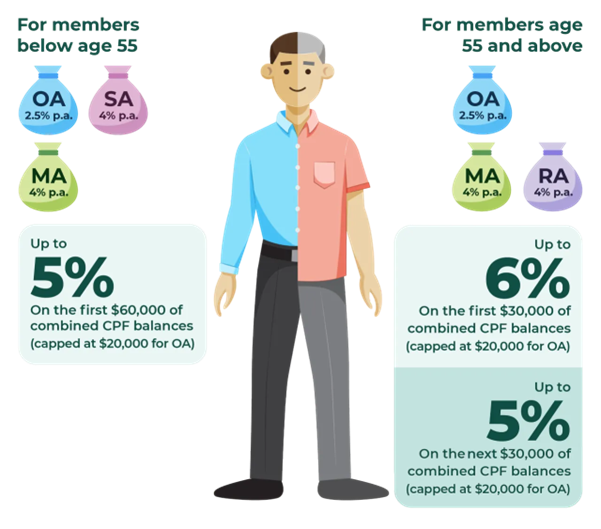

As depicted above, the interest rates in your OA, Special Account (SA), MediSave Account (MA) and Retirement Account (RA) are 2.5%, 4% (for the SA, MA and RA) per annum respectively. For members aged below 55, the Government pays extra interest rates on the first $60,000 of combined CPF balances, capped at $20,000 for the OA. This means your CPF savings can earn up to 5% interest rates per annum.

When you turn 55 years old, you’ll get additional interest too. You’ll earn interest rates of up to 6% for the first $30,000 of combined CPF balances, and up to 5% on the next $30,000, with the same cap of $20,000 for the OA. Factoring these interest rates into your calculations can help you get a more accurate idea of how your savings can grow over time.

CPF interest rates are pegged to returns on investments of comparable risk and duration in the market, and are reviewed quarterly.

Taking the OA as an example: as OA savings are used for more short-term needs such as housing, this rate is computed based on the 3-month average of major local banks' interest rates (subject to the legislated minimum interest of 2.5% per annum).

For the SA, MA and RA, however, the rate is computed based on the 12-month average yield of 10-year Singapore Government Securities (10YSGS) plus 1% (subject to the current floor interest rate of 4% per annum).

One key perspective to take when it comes to the CPF’s interest rate structure is that it remains a steady presence despite market conditions. In periods with a lower interest rate environment, the Government will continue to pay the minimum floor rate (such as 2.5% for OA savings and 4% for SMRA savings). This arrangement protects CPF members against investment risk, particularly the risk of negative returns, and ensures CPF savings are safe even when the market performs poorly. When it comes to something as important as your retirement nest egg, this can be a huge boon as the last thing you want is uncertainty.

Conversely, when the pegged rates exceed floor rates, your CPF savings will also correspondingly earn higher interest rates, as adjusted through the quarterly reviews.

While your CPF savings can grow steadily on their own, if you want to do more, there are also other actions you can take. One way is via cash top-ups to your CPF accounts, and the earlier you do so, the more time it gives your CPF savings to grow. Another way you can boost your retirement savings is via a CPF transfer from your OA to your SA or RA.

As top-ups and transfers are irreversible, it’s important to review your plans and finances before committing.

Another option to consider is the CPF Investment Scheme (CPFIS). CPFIS lets you invest your OA and SA savings in a wide range of investments to enhance your retirement savings. You can invest under CPFIS as long as you:

- Are at least 18 years old

- Are not an undischarged bankrupt

- Have more than $20,000 in your OA, and/or $40,000 in your SA

- Have completed the CPFIS Self-Awareness Questionnaire (SAQ)

You can choose to invest either your OA or SA savings, provided you have set aside the sums mentioned above. It’s also important to remember that, as with all investments, risks are involved. As such, you should only invest when the investments align with your risk appetite. If you’re unsure, you can consider the three smart principles for investing in Singapore to help you get started.

With different options to grow your CPF savings, there is no one right or best way to grow your CPF savings. What matters is to check and review your retirement plans as your needs may change over time, and to take the necessary steps to ensure you’re truly getting the most out of your CPF savings.

Information in this article is accurate as at the date of publication.

.jpg)